TL;DR

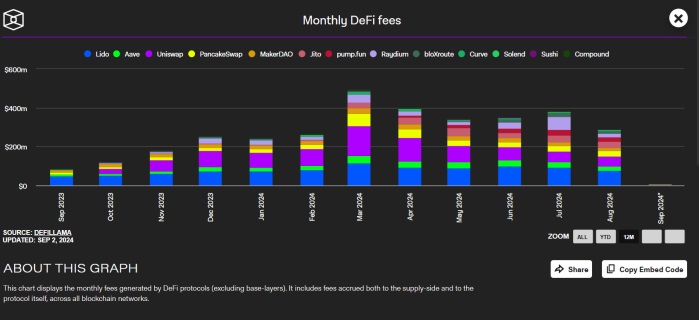

- In August 2024, DeFi protocol fees fell by 24.4%, totaling $288 million.

- The decrease is attributed to lower user activity, increasing competition among protocols, and variations in gas fees.

- Despite the overall decline, Lido, Uniswap, Jito, and PancakeSwap stood out in revenue generation. With Lido leading with $76.18 million in fees.

In August 2024, the decentralized finance (DeFi) sector experienced a significant drop in fees generated by its protocols, with a 24.4% decrease compared to the previous month. This brought the total sector fees to $288 million.

The decrease in fees can be attributed to several factors. One of the main reasons is the reduction in user activity on DeFi platforms, leading to a decrease in transaction volume and, consequently, in the fees generated.

Increasing competition among different protocols has also played a significant role, as the proliferation of similar options has fragmented the market and led to a reduction in fees to attract and retain users. Additionally, variations in gas fees on blockchain networks like Ethereum have impacted fees, as a decrease in transaction costs can reduce the total fees collected.

How Did Different DeFi Protocols Perform?

Despite the overall decline in fees, some DeFi protocols have managed to maintain their revenue generation. Lido, for example, emerged as the top fee generator in August, accumulating a total of $76.18 million. The liquid staking protocol has capitalized on the growing demand for staking solutions on networks like Ethereum. The transition to a proof-of-stake system has driven interest in its services.

In addition to Lido, other protocols like Uniswap, Jito, and PancakeSwap also performed well in fee generation. Uniswap, one of the most important decentralized exchanges (DEX), has maintained its relevance through its automated market-making (AMM) model, despite the general decrease in market activity.

Jito has shown solid growth, although it is less known compared to giants like Uniswap and Lido. While PancakeSwap has preserved its position as one of the top fee generators on Binance Smart Chain. Benefiting from a loyal user base and relatively low transaction fees.