TL;DR

- Bitcoin (BTC) surpassed $69,000 after a week of price volatility, driven by rumors of an investigation into Tether and geopolitical tensions due to an Israeli attack on Iran.

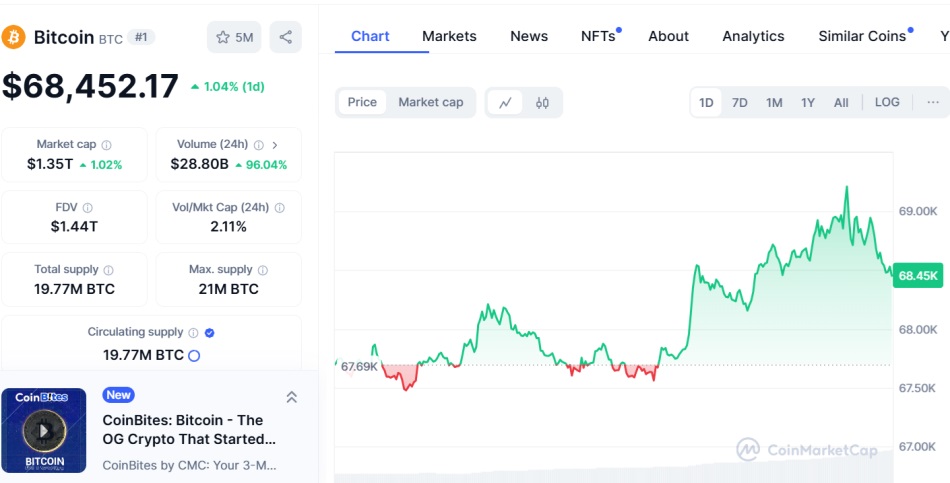

- Despite temporary price drops leading to liquidations exceeding $100 million, BTC showed a recovery with a 1.04% increase in the last 24 hours.

- Technical analysis indicates a bullish sentiment in the market, with strong buy signals in the moving averages.

Bitcoin (BTC) has managed to break the $69,000 barrier after a week marked by considerable price volatility.

Its rise follows the cryptocurrency nearing $65,000, propelled by two key events that have directly impacted the crypto market. On one hand, rumors surfaced about a U.S. government investigation regarding Tether, one of the major stablecoins in the market. On the other hand, the geopolitical situation intensified with an Israeli attack on Iran’s capital, creating an atmosphere of uncertainty that affected investors.

Despite market pressures that led to a temporary drop in prices, Bitcoin displayed a notable recovery, registering a 1.04% increase in the last 24 hours. This increase suggests a possible trend reversal in the behavior of the asset and investors. However, the context of the week was not easy, as more than $100 million were liquidated in the crypto market, including $43.04 million in long positions and $57.69 million in short positions.

Bullish Signals and Optimistic Outlook for Bitcoin

According to the latest data from CoinMarketCap, weekly gains exceed 2%. While it surpassed $69,000 a few hours ago, it has dropped again to $68,452. Market capitalization grew by 1%, exceeding $1.35 trillion. Additionally, trading volume increased by 96%, approaching $29 billion.

The technical analysis conducted by TradingView also supports the recovery of Bitcoin’s price, showing a bullish sentiment in the market. The moving averages indicate a strong buy signal, with figures reaching 17 and 14 respectively, while oscillators suggest a buy recommendation of 2. This technical backing provides investors with confidence in the near future for BTC, despite the volatility that has characterized the market in recent days.

It is noteworthy that the slight correction could be part of a natural process in which traders assess their positions and adjust their strategies in response to market fluctuations. Recent events highlight the need for investors to remain attentive to both political and economic dynamics that may influence BTC’s behavior.