Exchanges are critical parts of the cryptocurrency ecosystem. They provide the chance to trade and swap tokens, which are some of the most effective incentives for attracting new users. Two types of cryptocurrency exchanges are categorized by their governance system. Centralized exchanges are those that rely on a company in managing and governing the transactions. Decentralized exchanges or DEX don’t need any centralized player and connect traders. Uniswap is somehow a DEX that works on the Ethereum blockchain and provides token swap services. Besides, it has many more services that work based on P2P transactions.

What is Uniswap

Uniswap provides a set of services in Ethereum that helps people manage their trades and swaps without the need for a centralized system. In other words, it can be considered as a decentralized exchange that supports Ethereum-based tokens.

Besides, there are many other DeFi services that Uniswap offers. The most famous ones are liquidity pools that make it possible for users to lend their tokens and earn interest.

One of the best descriptions for Uniswap is that it’s an automatic liquidity protocol. Traders do their business without any need for middlemen. Besides, Uniswap focuses on the censorship-resistance in the protocol. The other important feature is that Uniswap is open-source software. Everyone can check its underlying code on GitHub.

Created in 2018 by Hayden Adams, Uniswap is one of the most famous DeFi providers in the Ethreum community. Vitalik Buterin, the Ethereum co-founder, described Uniswap’s underlying technology years ago.

How does it work?

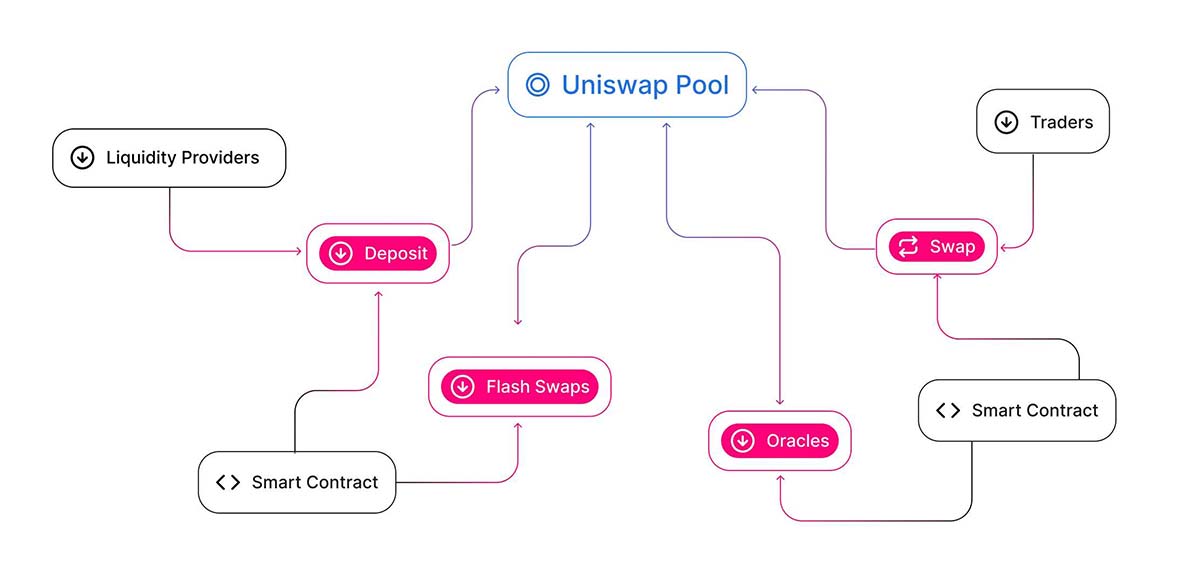

When a protocol works on a decentralized mechanism, there is no order book for traders. It needs liquidity to provide the needed tokens for swaps. Uniswap works on this base, too. It has a model that requires liquidity providers to create liquidity pools. Because of this model, Uniswap doesn’t have a listing process – unlike centralized exchanges – users can trade any ERC-20 token if there is a liquidity pool for that.

As mentioned before, you only need a liquidity pool to add an ERC-20 token to Uniswap. There should be some of the token and equal worth of Ethereum in that liquidity pool. Uniswap has a formula for determining the price of the token: x * y = k.

In the above equation, x and y are the amount or ERC-20 and ETH tokens available in the liquidity pool and k is a constant value. This formula makes it possible to determine the price of a token, based on supply and demand. When someone buys the ERC-20 token, the supply decreases for that token and it increases value. As a result, price change happens on Uniswap only when there is a trade.

Services

Uniswap is a comprehensive DeFi protocol that offers many services. It focuses on censorship-resistance and decentralization in all services. As a result, there are no middlemen needed in any of the services. Some of the most useful services are:

Token Swap

Swapping is the biggest service in Uniswap protocol. It provides the feature of swapping ERC-20 tokens for each other. It has a very simple process. You choose the input and output token in Uniswap, and the protocol calculates the amount of output token you will receive based on the amount of input token.

As mentioned before, there is no order book in Uniswap to determine the price of ERC-20 tokens. It has an automated mechanism called Automated Market Maker that shows the rates and slippage. All of the procedures are handled by smart contracts. They act as liquidity pools and hold balances of two unique tokens. Besides, the rules about depositing and withdrawing tokens are described in the smart contracts.

Pools

Pools are fundamental parts of Uniswap that manage the swapping process. They are trading venues for a pair of ERC-20 tokens. Each pool – smart contract – has zero balance of each token at the time of creation. When someone provides the initial amount of tokens – liquidity provider – they will determine the price of the pool, too. Other liquidity providers deposit pair tokens in a proportion to the current price. The mechanism is designed somehow that liquidity providers are incentivized to deposit an equal value of both tokens to the pool.

Liquidity tokens are another part you have to know about in Uniswap. The protocol mints them in the provider’s address. These tokens represent the liquidity that a user has provided to the pool.

Uniswap Governance

The governance system in Uniswap is like many other DeFi platforms. It’s based on the activities of UNI token holders. There are two other important parts in this system, called the governance module and Timelock.

You have to have at least 10M UNI tokens in your address to be able to propose governance actions in Uniswap. The proposal should contain finished, executable code. The community will vote for/against the proposal in three days. If the proposal receives the majority and at least 4M votes, Timelock comes into action and executes the change in a minimum of two days.

Timelock is a contract in Uniswap that can “modify system parameters, logic, and contracts in a ‘time-delayed, opt-out’ upgrade pattern”, according to Uniswap.

UNI the Uniswap token

UNI is the native token in Uniswap that has many use-cases. Governance is the most important use-case for UNI. Uniswap distributed UNI tokens to current community members, and also some of them will go to team members, investors, and advisers. Liquidity mining is another way of getting UNI tokens. Those users who provide liquidity to ETH/USDT, ETH/USDC, ETH/DAI, and ETH/WBTC will receive UNI tokens, too.

Pros and Cons of Uniswap

Uniswap is an excellent example of how decentralized exchanges can solve the big problems of trading in the cryptocurrency ecosystem. It helps people to trade tokens without the need to expose their identities.

Besides, it gives you full control over your tokens. There is no centralized middleman system in between, and you can easily trade without the common worries of centralized exchanges – like hack and breach or banning the account because of sanctions. The other good feature is the incentive for investors. Investment and earning rewards is easy in Uniswap and only needs to provide liquidity in pools.

Like any other technological innovation, Uniswap still needs improvement, too. It now only supports ERC-20 tokens that limit functionality and usability. Open listing is another part that needs improvement. Because of the current guideline, scam tokens can easily be added to the platform.

Conclusion

Decentralized exchanges are big improvements in the cryptocurrency ecosystem. They are vital steps toward full decentralization. Protocols like Uniswap have shown the capability of DEX services, and we can expect more similar protocols to emerge in the future. Adoption and attracting regular users are still big burdens. Uniswap and similar services should focus more on traditional markets to expand their user-base.