The financial sector is at a crucial moment. New kinds of services are emerging with considerable success in attracting users. Decentralized finance o DeFi is no longer an ambitious goal. It’s a fact that is changing the industry. These new services come with new terminology and features.

Impermanent loss is an essential component in the DeFi world. DeFi services work with multiple kinds of cryptocurrencies. Volatility is something natural in this world that affects users.

They may earn considerable profits with their tokens or lose some savings because of the change in value. Many DeFi services have guidelines to protect users’ assets from these changes.

Impermanent Loss

DeFi services have tools named Automatic Market Makers (AMM) to provide trading opportunities to users. These market makers need liquidity to be able to offer it in trades.

People deposit their tokens in DeFi platforms to provide the required liquidity. They receive trading interest for that. It’s the basis of a democratized financial sector that lets everyone have a role in the ecosystem.

Users who provide liquidity to DeFi platforms should know the mechanism of earnings and losses.

How and When the Impermanent Loss Happens?

As mentioned before, volatility is something natural in the cryptocurrency ecosystem. When you deposit your assets in a DeFi platform, you provide a cryptocurrency token as liquidity for a pool.

The value of your assets may change over time. As a result, you experience impermanent loss. The loss is impermanent because the design in AMMs has made it this way.

In a nutshell, when the dollar value of your holdings is less or more during withdrawal than the deposit, the impermanent loss has happened. More change in the value means more loss for the user.

Some pools have a less impermanent loss. They’re meant for trading tokens that have a limited range of change in value. Stablecoins are great examples here. Their value doesn’t change and liquidity providers have ease of mind regarding the impermanent loss.

Impermanent loss isn’t something that scares you from providing liquidity in DeFi platforms. The trading fees that platforms like Uniswap and SushiSwap offer reasonable trading fees to liquidity providers (LP) that somehow compensates the impermanent loss. After all, everything depends on the algorithm of the DeFi platform.

Liquidity providers should be aware of the impermanent loss risks. The loss happens no matter the change in the price is positive or negative. When the balance between the prices of two tokens in a pool changes, the impermanent loss happens. Many procedures in DeFi platforms try to mitigate risks, but some pools have a significant impermanent loss and are suitable only for experienced traders.

How Is It Calculated?

Calculating the impermanent loss differs in multiple DeFi platforms. It’s based on the protocol, algorithms, and tokens.

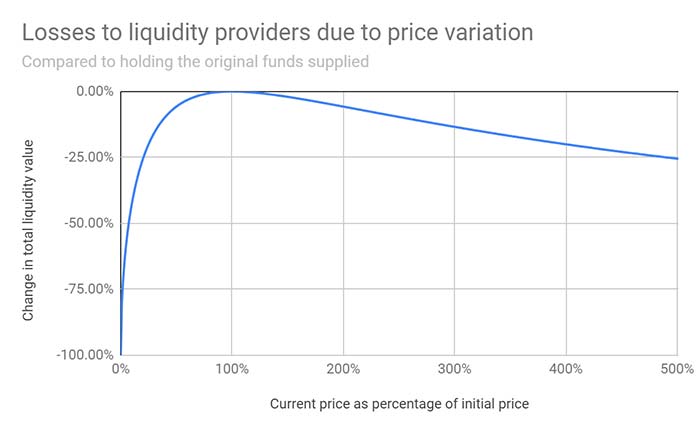

Some simulators predict your impermanent loss in some DeFi platforms. There is a graph that shows the estimated loss, too. Some have formulas. n=but after all, nothing is a non-changing fact.

The famous estimation graph for impermanent loss says that when the price of an asset changes about 500%, your impermanent loss is about 25%. The loss decreases with less change in the value of tokens in the liquidity pool.

The crucial thing about impermanent loss is that your loss becomes permanent only when you withdraw assets from the platform.

How to Avoid Impermanent Loss?

As mentioned before, most of the time, the trading fee you earn in a DeFi platform compensates for the losses. But you have to be very careful when investing as a liquidity provider in those platforms.

Traders should know the details of algorithms in each DeFi platform before providing liquidity for them. Some pools have more chances of impermanent loss than others. Their tokens are prone to high volatility, and compensating the loss sometimes becomes impossible. It is the nature of AMM.

It’s better to start providing liquidity with small amounts. Don’t deposit all of your holdings in one DeFi platform and one liquidity pool. You can estimate the impermanent loss in a pool by small amounts and decide to increase or decrease holdings.

Another thing to keep in mind is about trusting the AMMs. The DeFi sector is booming, and many new platforms emerge every day. Some new ones may be scams or don’t have the required security protocol to compensate for your losses. The best way to avoid those platforms is to look at their trading fee offerings. Some DeFi services claim high trading fees and earnings that may not be logical in markets.

There are some other solutions to avoid impermanent loss in DeFi platforms. Some of them are:

-

Providing liquidity to stablecoin pools

-

Participating in liquidity mining programs. Some DeFi platforms have liquidity mining programs that compensate for your impermanent loss.

-

Keep the liquidity until the rates come back to the initial rate

-

Avoiding volatile cryptocurrency pairs

-

Providing liquidity to pools with unevenly weighted cryptocurrencies

Conclusion

No investment is free from possible losses. Liquidity providing is a new solution for those who want to have extra earning from their cryptocurrency holdings. It’s the product of the DeFi boom and has attracted many investors. But you have to be careful in this kind of investment, too. You should know where to deposit holdings and how much loss to be ready for.

Impermanent loss happens when the value of your provided liquidity in a DeFi platform changes. It doesn’t matter the change is positive or negative.

The Automated Market Maker mechanism results in a loss. The loss becomes permanent when you withdraw liquidity from the pool.

You can prevent this loss by keeping the liquidity until the rates come back to normal. Avoiding volatile cryptocurrency pairs is another solution for that.