TL;DR

- The crypto market recorded record investment inflows of $2.2 billion, driven by euphoria following Trump’s inauguration.

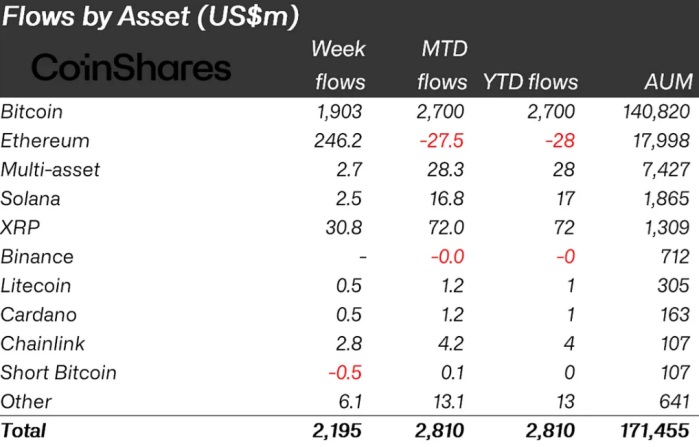

- Bitcoin led the inflows with $1.9 billion, while Ethereum experienced a recovery with $246 million, though it remains one of the worst performers in 2025.

- XRP continues to attract investments, with $31 million last week, reaching a total of $484 million since November 2024.

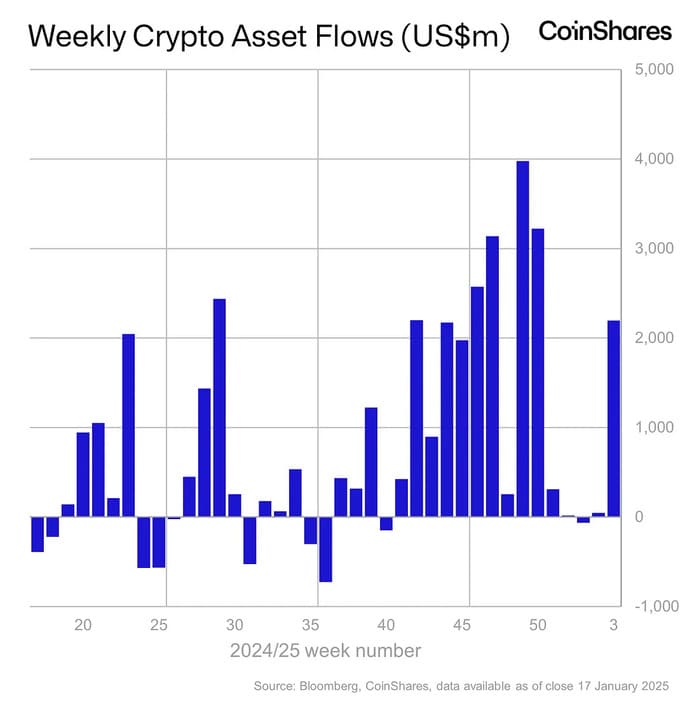

The past week has been crucial for the digital asset market. There was a notable increase in investment flows, with a total of $2.2 billion entering cryptocurrency investment products, fueled by the euphoria surrounding Donald Trump’s inauguration.

This event generated the largest investment inflows of 2025 so far, also pushing assets under management (AuM) to a historic high of $171 billion. Throughout the year, accumulated inflows reached $2.8 billion, demonstrating strong investor confidence in digital assets.

Bitcoin has been the main beneficiary of these inflows, with $1.9 billion, raising its total investment flows for the year to $2.7 billion. Despite recent price increases, there were minor outflows in short positions, which is somewhat unusual given the cryptocurrency’s bullish momentum.

On the other hand, Ethereum experienced a recovery with an inflow of $246 million, partially correcting the investment outflows seen earlier this year. Despite the rebound, it remains one of the worst-performing cryptocurrencies in terms of investment flows in 2025.

Much Optimism in the Crypto Market

XRP continued to show strong demand, with $31 million in inflows last week. Since November 2024, XRP has accumulated an impressive $484 million in inflows, solidifying its position as one of the most attractive assets for investors. In contrast, other altcoins showed more moderate activity. Solana only received $2.5 million, and Stellar reached $2.1 million in inflows.

The upward trend in fund flows, especially in the United States, suggests that interest in cryptocurrencies remains strong, supported by macroeconomic and political factors that are boosting confidence in the market.