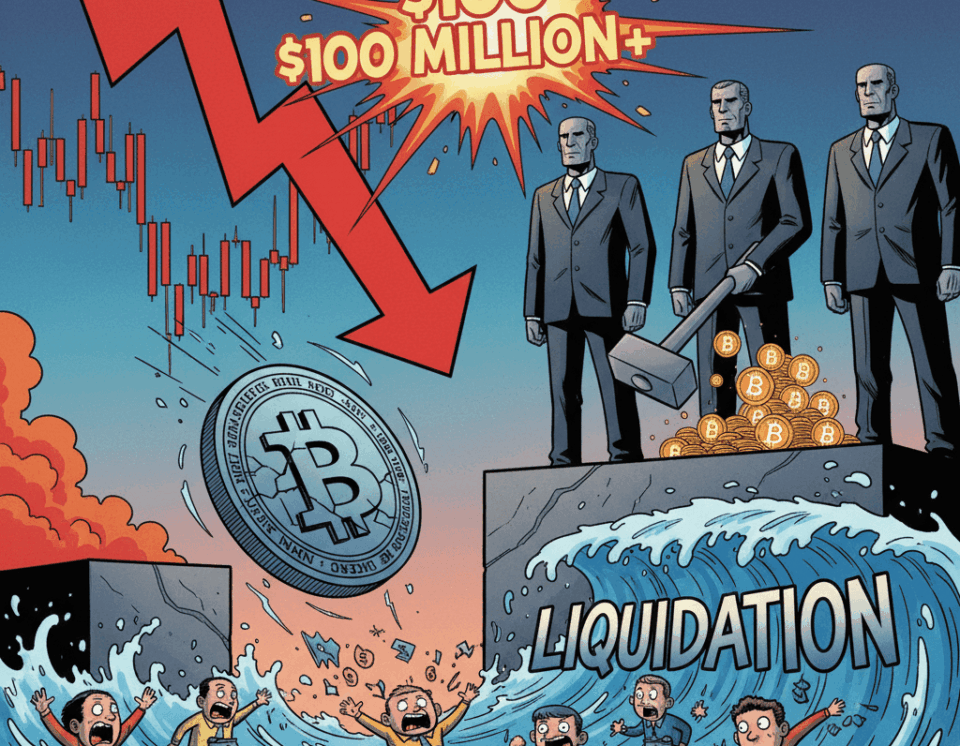

Retail investors demonstrated their market strength, triggering nearly $700 million in liquidations from Bitcoin’s fall and that of other crypto assets. This event occurred after a decrease of approximately $4,000 in BTC’s price, despite institutional buying remaining strong, according to data from the platform CoinGlass. The dynamic reveals a key tension in the current market structure.

Retail Investors vs. Institutional Capital: Who Moves the Market?

Recently, the debate in the community centered on whether large inflows of institutional capital would nullify the traditional four-year market cycles. Growth had been driven by large companies buying BTC even at high prices, leading analysts like Arthur Hayes to suggest that corporate liquidity would now dictate prices. However, the recent volatility shows that retail investors still hold considerable power to generate sharp movements. Key evidence is a 4-5% increase in on-chain activity, indicating a return of the retail sector, likely to take profits.

The context for these liquidations is a standard market correction. After hitting successive all-time highs, profit-taking by long-term holders and other technical factors caused the decline. Although Bitcoin ETFs continued to see massive inflows, the retail selling pressure was enough to trigger a cascade of forced position closures, wiping out over $114 million in short positions in just one hour.

The Persistent Power of Retail and Implications for BTC’s Price

This episode offers valuable data on the new forces structuring the market. While institutional liquidity can establish a solid foundation and a long-term trend, retail activity continues to drive short-term volatility. The narrative that institutions are the sole arbiters of price seems, for now, less certain. The retail sector’s ability to generate a significant drop and a wave of liquidations is proof of its continued relevance.

Looking ahead, the main question for traders is how to interpret this behavior to make accurate predictions. Although the correction was sharp, there are signs that BTC could rebound soon. Regardless of the price direction, the interaction between institutional buying and retail selling will be a key factor to watch. Institutions seem willing to continue accumulating Bitcoin, but market movements will remain influenced by the decisions of millions of individual investors.