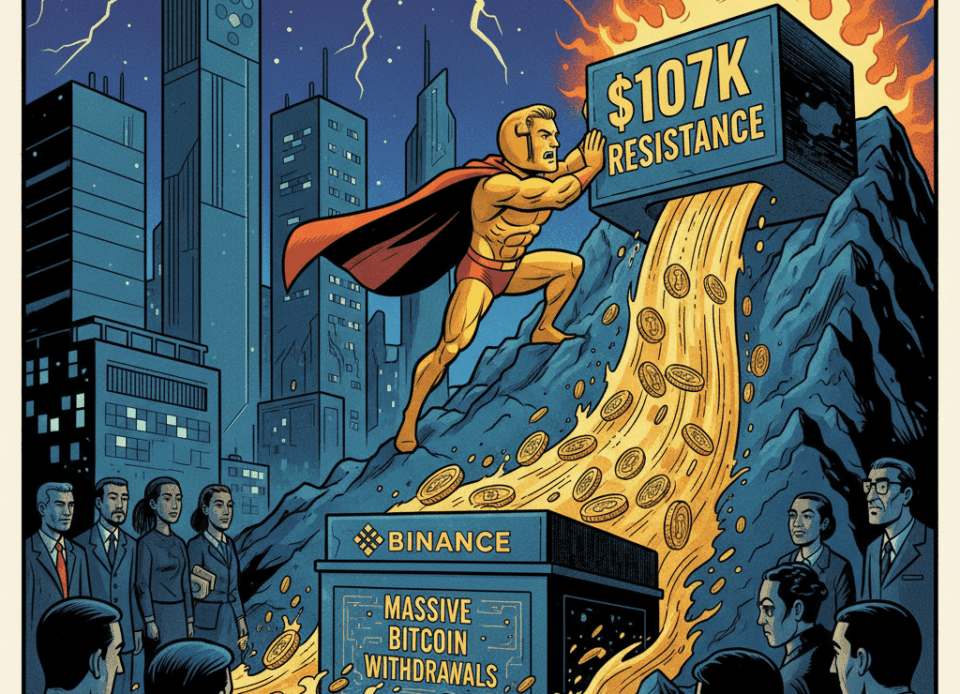

Bitcoin (BTC) reclaimed the $105,000 level this Wednesday, maintaining its November pattern of higher lows. As traders assess the key $107,000 resistance, the on-chain analytics platform CryptoQuant highlighted a significant spike in Bitcoin withdrawals from Binance, signaling a potential accumulation phase.

BTC price showed strength on short-term charts. It managed to preserve the higher-low structure in place since November 5. According to XWIN Research Japan, a CryptoQuant contributor, Binance recorded a sudden spike in withdrawals earlier in the month. This event was one of the largest surges of 2025 and coincided with the BTC price hitting $103,000.

Is whale accumulation enough to break the resistance?

This movement on the exchange is seen as a bullish signal. It indicates a significant shift in investor behavior. Furthermore, the analysis noted an increase in OTC (over-the-counter) desk activity. This suggests private transfers to custodial wallets, which is another sign of active institutional participation in the Bitcoin blockchain.

However, trader opinions are divided on the next move. Trader Daan Crypto Trades stated that BTC needs to break the $107,000 area to confirm a bullish turnaround. On the other hand, Crypto Tony described the $107,400 zone as the “perfect short zone,” anticipating a potential rejection at that level.

The market is at a point of tension. On-chain data suggests strong accumulation, but the price action faces crucial technical resistance. If Bitcoin fails to overcome $107,000, it could face further consolidation or a pullback. Investors are watching if the Bitcoin withdrawals from Binance will translate into sustained bullish momentum.