The BNB token has demonstrated remarkable recovery capability, quickly climbing back above $970 after a brief drop to $953 on November 12, 2025. This fluctuation, though sharp, underscores the complex interplay between selling pressure, the token’s intrinsic demand, and its tokenomics mechanisms, directly impacting traders, BNB Chain participants, and liquidity managers.

According to Binance Market Data records, the previous day saw a price of 966.969971 USDT, representing a 1.73% drop in 24 hours. The BNB token has tested significant psychological and technical supports, including the $1,080 and $1,000 levels in recent phases. Despite these pressures, it has occasionally managed to stabilize above the $1,000 barrier, an indication of its underlying strength.

Will the BNB token’s utility prevail over bearish pressure?

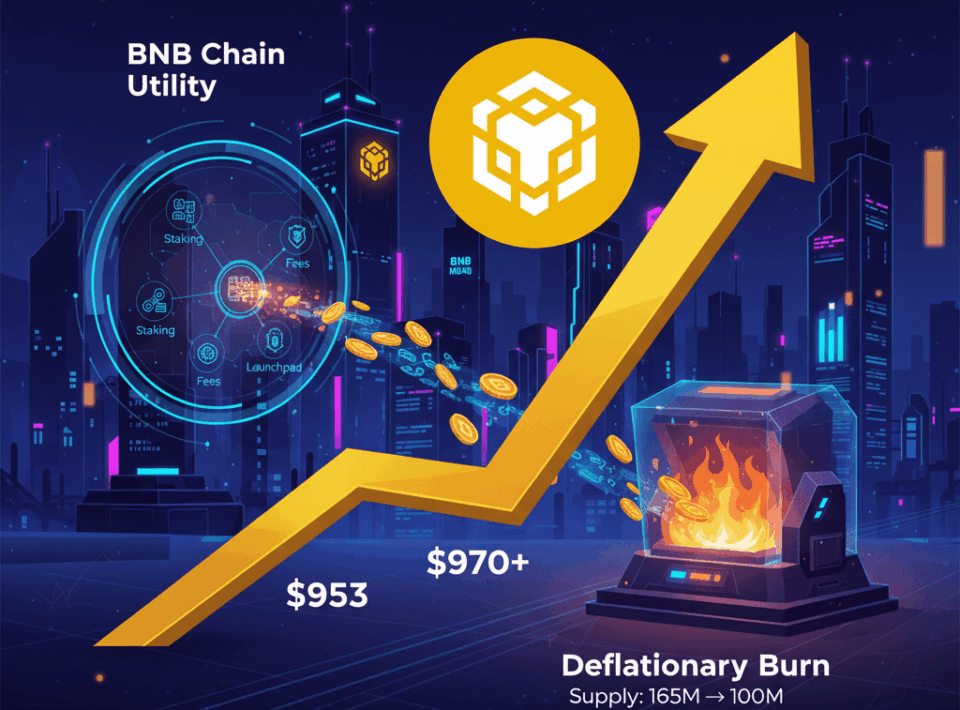

In technical analysis, some experts have identified the formation of a “double top” pattern. This pattern is interpreted as a signal of potential additional bearish pressure, which could lead to drops of up to 30%. Nevertheless, the BNB token’s resilience is fundamentally based on its utility within the ecosystem. It is actively used to reduce fees, participate in staking, and in token launches on Launchpad, thereby ensuring fundamental demand.

Furthermore, its design includes a quarterly burning mechanism, aimed at reducing the circulating supply from 165.1 million to a target of 100 million. This deflationary process, in this way, strengthens the token’s scarcity narrative.

The current market dynamic has concrete effects. Operational demand helps maintain the BNB token’s support levels, while volatility can increase liquidation risk and affect intraday liquidity. In the short term, some analysts project a possible rebound towards $1,200 by year-end. The next key observation period will focus on the evolution of trading volumes and the next scheduled quarterly burn by the company.