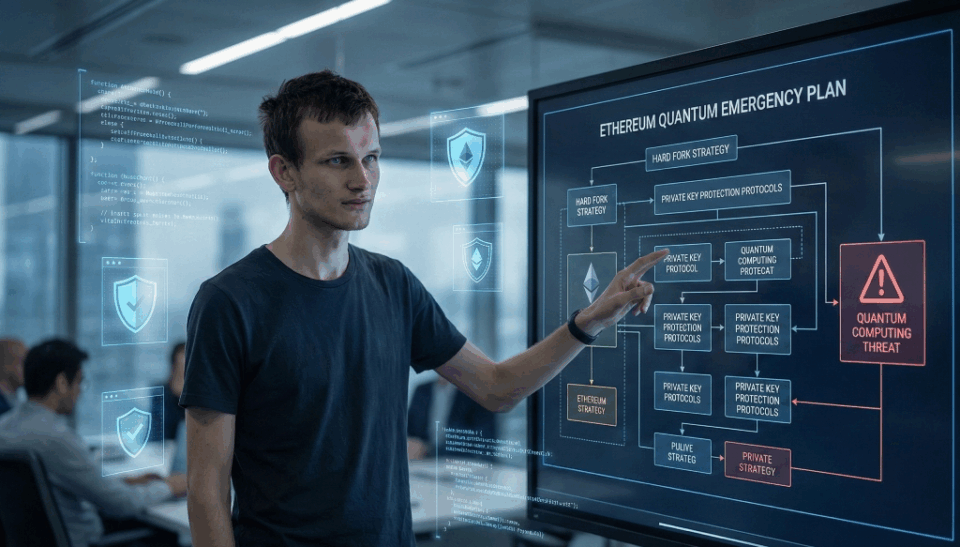

Vitalik Buterin, co-founder of the network, has recently outlined an Ethereum emergency plan to counter the imminent risks posed by technological advancement. Citing his own research and prediction data, the developer proposes drastic measures, including hard forks, to safeguard user assets against a possible breakdown of current security protocols.

The central concern lies in the future capability of machines to execute Shor’s algorithm, specifically designed to decipher the elliptic curve multiplication that protects private keys. According to data from the Metaculus platform cited by Buterin, there is a 20% chance that this technology will break modern cryptography before 2030. In the face of a sudden breakthrough, the network would implement a block rollback to reverse transactions and freeze vulnerable accounts to prevent massive thefts.

What would happen if current cryptography suddenly collapses?

To mitigate these risks in the long term, the strategy focuses on the massive adoption of upgradeable smart contract wallets, known as account abstraction. These tools allow switching to signatures resistant to quantum technology as soon as they become available, offering a proactive security layer. On the other hand, although the current blockchain remains safe, the need to replace underlying cryptographic components is imperative to ensure the future integrity of zero-knowledge proofs and secondary layers.

In the financial realm, the token has experienced a difficult November, with spot ETFs recording historical outflows exceeding 1.42 billion dollars, reflecting caution in the market. Currently, the price of Ether struggles to hold above the support of 2,829 dollars, a critical level to avoid larger drops towards annual lows. If the bulls manage to defend this zone and break the resistance of 3,000 dollars, the asset could seek to recover the level of 3,500 dollars in the short term.

Finally, the safety of funds will depend on the orderly transition towards new cryptographic standards and constant vigilance of official updates by users. Although the catastrophic scenario still seems distant, early preparation is fundamental to avoid operational chaos in the network. Likewise, investors must closely monitor technical indicators such as the RSI and institutional capital flow, as they will define the market trend in the coming weeks.