What are real-world assets (RWAs) in crypto?

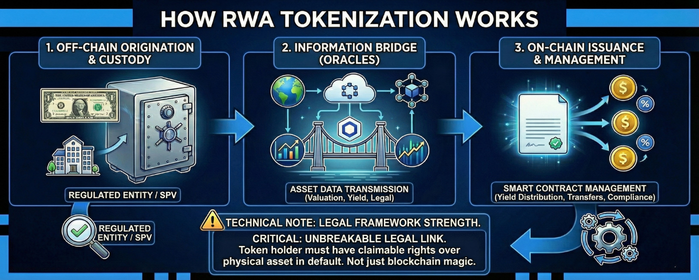

How RWA tokenization works

- Off-Chain Origination and Custody: The asset (e.g., a U.S. Treasury bill) is acquired and held by a regulated entity or a Special Purpose Vehicle (SPV). This guarantees the asset exists and is audited.

- Information Bridge (Oracles): Asset data (valuation, yield, legal status) is transmitted to the blockchain via oracles like Chainlink, ensuring the on-chain price reflects market reality.

- On-Chain Issuance and Management: Tokens representing fractions of that asset are issued. The smart contract automatically manages yield distribution, transfers, and in some cases, compliance (allow-lists).

Technical Note: The key to RWA success is not blockchain technology per se, but the strength of the legal framework ensuring the token holder has claimable rights over the physical asset in case of default.

How RWAs generate yield in DeFi

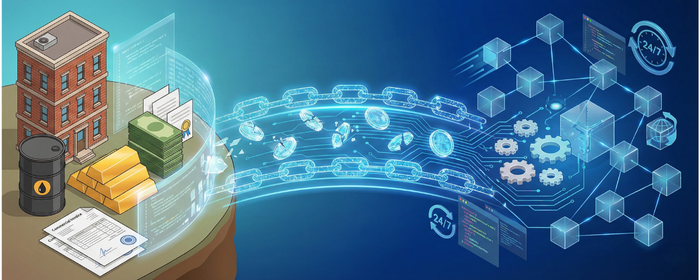

Unlike traditional “Yield Farming” in crypto, which often relies on inflationary governance token issuance (printing money to pay interest), RWA yield is sustainable and exogenous.The flow of money follows this logic:- Public Debt: The protocol invests in T-Bills. The government pays interest, and the protocol passes that interest to the RWA token holder.

- Private Credit: Investors lend stablecoins to real-world businesses. These businesses repay the loan with interest generated by their productive economic activity.

- Real Estate: Yield comes from collected rents, automatically distributed to holders of the fractionalized token.

RWAs vs traditional finance instruments

To visualize the magnitude of this disruption, it is essential to contrast legacy infrastructure with the efficiency of tokenization.| Feature | Traditional Finance (TradFi) | RWAs in Crypto (DeFi) |

| Trading Hours | Monday to Friday (Bank hours) | 24/7/365 |

| Settlement | T+2 days (Slow and inefficient) | T+0 (Near instant) |

| Barrier to Entry | High (High investment minimums) | Low (Fractionalization from $50) |

| Transparency | Opaque (Quarterly reports) | Transparent (On-chain verifiable) |

| Composability | None (Closed silos) | High (Use token as collateral in DeFi) |

Use cases: where RWAs are transforming finance

The rwa crypto narrative goes beyond theory. Currently, there are sectors where traction is evident and measurable, backed by data from analytical platforms like DeFiLlama:- Tokenized Treasuries: Given high global interest rates, projects like Ondo Finance have allowed crypto users to access the “risk-free rate” of the dollar without leaving the blockchain.

- Trade Finance: Small businesses in emerging markets use DeFi platforms to obtain fast liquidity against accounts receivable, bypassing local banking bureaucracy.

- Commodities: Tokenized gold and silver (like PAX Gold) allow for the ownership of precious metals without physical storage costs or transport issues.

Top RWAs Projects

If you are wondering where to buy rwa crypto or which projects are leading the vanguard, it is vital to look at those with solid metrics and regulatory compliance.- Ondo Finance (ONDO): Pioneers in bringing U.S. Treasuries on-chain. Their OUSG and USDY products are industry standards for institutional treasury management.

- Mantra (OM): A Layer 1 blockchain designed specifically for RWAs (see Mantra Chain), focusing on regulatory compliance and institutional security from the ground up.

- Centrifuge (CFG): An infrastructure protocol connecting real-world assets (like invoices and royalties) with DeFi liquidity. It is the technology behind much of the credit in MakerDAO.

- MakerDAO (MKR): While known for DAI, Maker is one of the largest holders of RWAs, backing its stablecoin with public debt and corporate assets to ensure stability.