The Real World Asset (RWA) narrative has shifted from a futuristic promise to the most solid liquidity engine of the current cycle. If you are here looking for an Ondo Finance Review, it is because you intuit that sustainable yield is found not in the inflation of utility-less tokens, but in US sovereign debt.

In this technical analysis, we will break down how Ondo Finance has positioned itself as the undisputed leader in the tokenization of institutional securities. You will understand the architecture behind its products, the safety of its capital flows, and why giants like BlackRock play a crucial role in its ecosystem. This isn’t just about buying a token; it’s about understanding how traditional financial infrastructure is migrating to the blockchain.

What is Ondo Finance?

To fully grasp what is ondo crypto, we must move away from the simplistic definition of “just another DeFi protocol.” Ondo Finance is an institutional-grade financial entity operating on-chain. Its primary mission is to democratize access to institutional financial products (such as US Treasury Bonds) that have historically been reserved for accredited investors with massive capital.

Unlike DeFi 1.0 protocols that generated yields through the inflationary emission of their own tokens, Ondo acts as a manager of tokenized assets. Under this technical premise, the protocol issues tokens representing fractional ownership of real assets held off-chain.

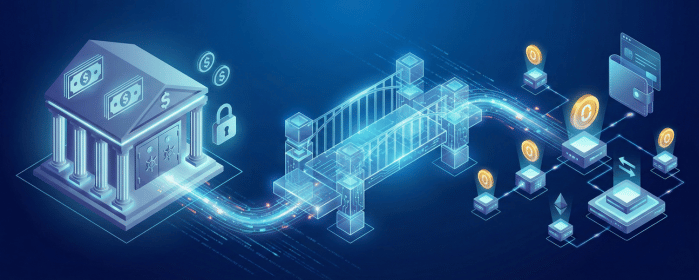

Essentially, Ondo is the “middleware” connecting cryptocurrency liquidity with the safety and yield of US capital markets. You can verify the technical details of this structure in their official documentation.

How Ondo Finance works

Ondo’s operations are distinguished by strict regulatory compliance and a trust-minimized architecture. If we break down this mechanism, the workflow is as follows:

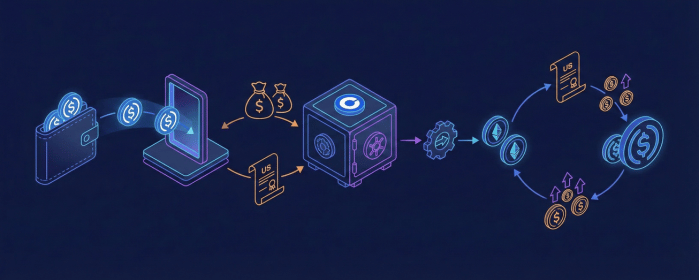

Capital Inflow: Users deposit stablecoins (USDC) into the Ondo platform.

Conversion and Custody: Through regulated custody partners (like Coinbase Prime), that fiat money is used to purchase underlying assets, such as short-term Treasury bond ETFs.

Tokenization: The protocol mints equivalent tokens (like OUSG or USDY) representing the legal claim on those custodied assets.

Yield Management: Interests generated by the real bonds are distributed to on-chain token holders, either by adjusting the token value or through rebasing.

Consequently, when you interact with Ondo, you are not “betting” against an algorithm; you are indirectly purchasing US debt with a layer of blockchain technology that allows for instant transferability and collateralization.

What makes Ondo different from other RWA platforms

In a market saturated with projects promising Tokenized Equities or real estate, Ondo stands out for its pragmatism and partnerships. While others try to tokenize illiquid assets (like houses), Ondo focuses on the most liquid asset in the world: Cash equivalents.

Integration with BlackRock: Ondo was a pioneer in using BlackRock ETFs as underlying assets. With the rise of institutional initiatives, Ondo’s position is strengthened by having direct access to institutional liquidity funds.

Focus on Compliance: Unlike anonymous protocols, Ondo has separate arms for institutional investors (requiring strict KYC) and products for the global retail market (with specific legal structures).

Market Dominance: According to RWA.xyz, Ondo consistently leads the volume and TVL in the tokenized treasuries category, validating its adoption against smaller competitors.

Yield generation and return mechanics

Where does the money come from? This is the critical question. In Ondo, the return is pure “Real Yield.” It does not come from speculation.

When the Federal Reserve (Fed) keeps interest rates high, Treasury Bonds pay that percentage. Ondo captures that yield from the underlying asset (the bond or ETF) and transfers it to the token holder, deducting a small management fee.

If we analyze what are tokenized treasuries, we see they act as a mirror: if the government bond yields 4.8% APY, the Ondo product will yield approximately the same. This removes crypto market risk (BTC or ETH volatility) and replaces it with interest rate and counterparty risk, which in the case of the US government, is considered the global “risk-free rate.”

ONDO RWA Products (Flux, USDY, OMMF)

Ondo’s catalog is designed for different investor profiles. Here we dissect the most relevant ones:

1. OUSG (Ondo Short-Term US Government Treasuries)

This is the flagship institutional product. It invests predominantly in short-term Treasury bond ETFs.

Profile: Accredited Investors.

Use: Corporate treasury and capital preservation.

2. USDY (US Dollar Yield)

This is the “game changer” for the common user. USDY is a tokenized note secured by short-term Treasury Bonds and bank demand deposits.

Key Difference: Unlike USDT or USDC which pay nothing to the user (the issuer keeps the yield), USDY pays the generated interest directly to the holder.

Profile: Non-US Investors (Retail and Institutional).

3. The Governance Token (ONDO)

It is vital to distinguish between the products (USDY, OUSG) and the governance token ONDO. The token allows voting on the protocol’s future, economic parameter changes, and new integrations. Its value is speculative based on the platform’s success, while USDY is stable value. You can track its performance on reliable on-chain data sources.

Comparative Table: USDY vs. Traditional Stablecoins

| Feature | Ondo USDY | USDT / USDC |

| Source of Value | US Treasury Bonds + Deposits | Cash and Equivalents |

| Yield (APY) | ~4.5% – 5.2% (Variable) | 0% (Issuer keeps it) |

| Legal Protection | Bankruptcy-remote secured note | Audited reserves (varies) |

| Accessibility | Global (Excludes US) | Global |

| Regulation | Reg S (Securities Law) | Varies by jurisdiction |

[Insert internal link to: News on Stablecoin Regulation in Europe]

Future: Tokenized Equities

Although the current focus is debt, Ondo’s infrastructure lays the groundwork for tokenized US stocks NVDA AAPL. Through interoperability with derivative protocols and potential mandate expansion, it would not be surprising to see future baskets of tech stocks backed in the same secure way bonds are today, allowing for 24/7 on-chain trading under SEC oversight.

Frequently asked questions (FAQ)

Is Ondo Finance safe?

Yes, within financial risk standards. Ondo uses top-tier custodians (like Coinbase and Clear Street) and recognized asset managers. Furthermore, assets are held in separate legal vehicles (SPVs), meaning Ondo’s creditors cannot claim user assets in the event of corporate bankruptcy.

How does Ondo generate yield?

Yield comes strictly from the interest paid by the underlying assets (US Treasury Bonds and reverse repos). There is no risky lending to “traders” or algorithmic leverage. It is the interest paid by the US government transferred to the blockchain.

Can retail investors access Ondo products?

Yes, but with nuances. The OUSG product is reserved for Accredited Investors. However, USDY is designed specifically for the global market (excluding residents of the US and sanctioned countries), allowing individuals to access institutional yields without high minimum entry barriers.

How does Ondo differ from stablecoin yield platforms?

Most stablecoin “yield” platforms lend your money to other users (default risk) or engage in complex DeFi strategies. Ondo does not lend your money; it invests it in US sovereign debt, considered the safest investment in the financial world.

Conclusion

Ondo Finance is not trying to reinvent the wheel; it is putting a Ferrari engine on capitalism’s oldest wheel: sovereign debt.

For the smart investor, the value proposition is clear: Why hold dollars in a stablecoin that devalues with inflation, when you can hold an asset like USDY that preserves purchasing power with institutional backing? Ondo represents the maturity of the crypto sector, moving from pure speculation to real financial integration.

Last update: February 17, 2026.