TL;DR

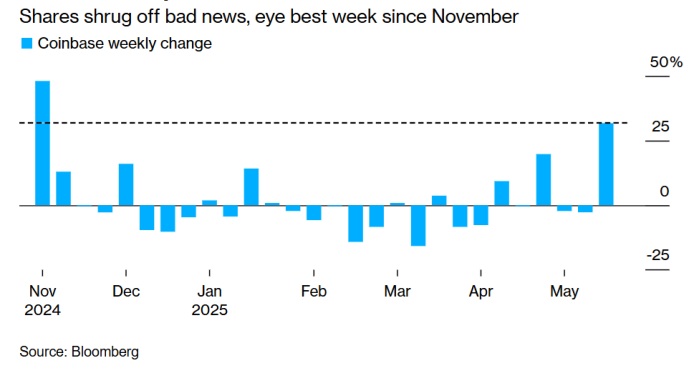

- Coinbase’s shares rose more than 30% after announcing its inclusion in the S&P 500, which requires passive funds and ETFs to buy its stock.

- A cyberattack estimated to cost $400 million and a regulatory investigation into user numbers briefly impacted the stock price, which fell 7.2%.

- Although demand for its shares will continue due to the index inclusion, fund purchases may slow down, and its performance will set a benchmark for other crypto firms.

Coinbase’s stock climbed over 30% last week after it was announced that it will join the S&P 500 index, replacing Discover Financial Services. This inclusion forces passive funds and ETFs tracking the index to buy shares of the company, explaining the strong capital inflow into its stock regardless of its operating results.

Challenges and a Temporary Setback

Midweek, a serious issue emerged: a cyberattack that could cost the company around $400 million. Shortly after, US regulators confirmed an investigation into the exchange’s reported user figures. This double blow caused the stock price to drop 7.2%, but the decline was short-lived and did not fully undermine investor confidence.

Several analysts say the support from joining the S&P 500 will sustain demand for Coinbase shares over the coming days. However, when these investment funds make their final portfolio adjustments, the buying pace will slow down and may trigger selling pressure. Market watchers warn that Coinbase’s performance in the index will serve as a reference for other crypto companies aiming to join this select group of Wall Street-listed firms.

Coinbase Shows Strong Market Performance

Despite the challenges, the company maintains solid results. Coinbase closed the quarter with a 24% increase in annual revenue and completed the $2.9 billion acquisition of Deribit. This move will help expand its product offering and strengthen its position in the US digital asset market.

So far in 2025, its stock has gained nearly 6%, outperforming the S&P 500 index despite recent volatility. This growth reflects the interest from both large investors and retail traders.

Coinbase’s next challenge will be managing its issues while proving it can sustain growth and reputation in an increasingly competitive market