TL;DR

- Binance Futures has launched the HYPEUSDT perpetual contract with up to 75x leverage, opening new opportunities for both retail and institutional traders.

- This move has triggered a 33% surge in HYPE’s trading volume within just 24 hours.

- Despite recent volatility, the HYPE token is showing signs of recovery, jumping 10% after Binance’s announcement.

The cryptocurrency exchange giant Binance has added the HYPEUSDT perpetual contract to its Futures platform, allowing leverage of up to 75 times. This decision, which took effect on May 30 at 6:30 PM Beijing time, aims to strengthen the DeFi ecosystem facilitated by Hyperliquid, a blockchain project focused on the performance of decentralized applications and innovative trading solutions designed to push crypto adoption forward across multiple user levels and global regions, especially in underserved digital economies.

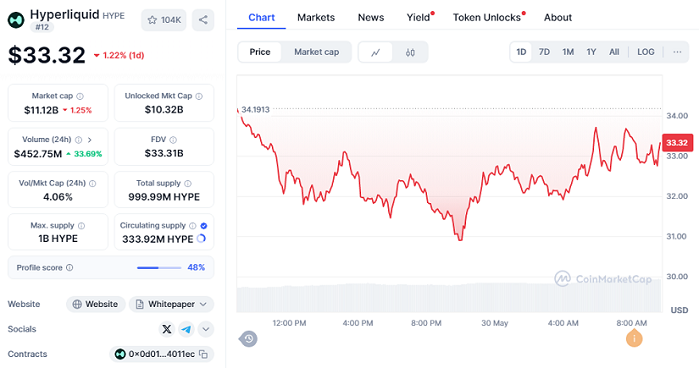

Currently, HYPE is priced at $33.32, with a market capitalization of $11.12 billion and a trading volume that has increased by 33.69% in the past 24 hours, reaching $452.75 million. This surge in trading activity has sparked increased speculative interest, especially among more aggressive traders, thanks to the high exposure enabled by Binance’s leverage offering and the growing anticipation surrounding future token listings and market expansion on major exchanges.

High Exposure and Volatility Appeal to Traders

The contract, settled in USDT, is part of Binance’s strategy to expand its offering of emerging tokens in high-liquidity environments. Although HYPE is not yet listed on Binance’s spot market, its inclusion in the futures market already led to a 10% price increase following a 13% drop due to the recent overall crypto market correction.

Additionally, Binance will activate the Copy Trading feature for this contract within 24 hours of the trading launch, allowing less experienced users to replicate the strategies of professional traders. This broadens participation in the fast-growing global derivatives market.

Listing History Shows Temporary Positive Trends

According to Coinglass data, open interest in HYPE futures rose 2.31% in just four hours, reaching $1.26 billion. These types of moves often attract explosive, albeit short-lived, trading volume. Over the past 30 days, HYPE has appreciated 82%, confirming its strong appeal within the DeFi segment.

These kinds of initiatives reinforce the narrative that cryptocurrencies and their derivatives remain key instruments in the evolution of global financial markets. By expanding options like the HYPEUSDT contract, Binance is offering more tools for those who see not just volatility in the crypto economy, but opportunity.