TL;DR

- The Bitcoin market has experienced improvements in liquidity since the collapse of FTX, especially with the approval of Spot ETFs.

- Liquidity refers to the ease of buying and selling an asset without significantly affecting its price, helping to reduce BTC price volatility.

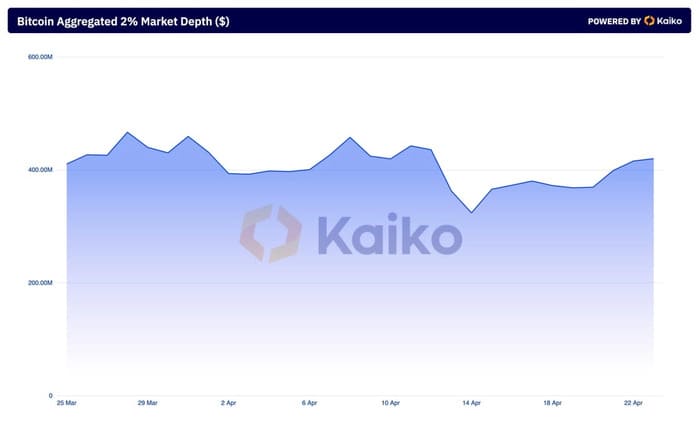

- The aggregated liquidity of the BTC market has steadily grown since the last halving in April.

Since the collapse of FTX, the Bitcoin (BTC) market has experienced significant improvements in its liquidity, especially with the approval of Spot ETFs. This improvement in liquidity has led to an increase in market confidence, building positive expectations for the future price of BTC.

Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. In the case of Bitcoin, greater liquidity means there are more participants willing to buy and sell the cryptocurrency, which helps reduce price volatility and mitigate the impact of large sell-offs.

According to data from Kaiko, since the last BTC halving in April, the aggregated liquidity of the Bitcoin market has experienced steady growth. Driven in part by the approval of ETFs, which have facilitated investors’ access to the BTC market without the need to directly own the cryptocurrency.

Optimistic Future for Bitcoin

However, there are concerns about trading activity during weekends. Historically, BTC trading volumes tend to decrease over weekends, which can affect liquidity and market stability. However, so far, trading volumes have not been significantly impacted by the halving.

Regarding the macroeconomic outlook, there is a correlation between low-interest rates and investment in risk assets like Bitcoin. During periods of low-interest rates and stable inflation, BTC tends to experience bull runs. However, improved demand and liquidity will be crucial to maintaining this bullish trend in the coming months.

If this liquidity trend continues, it could support sustained growth in the price of Bitcoin towards the end of 2024. However, trading activity and macroeconomic conditions will remain important factors for investors to consider.