TL;DR

- Over the past 24 hours, more than $827 million in long positions have been liquidated as Bitcoin fell below the critical $80,000 mark.

- The sharp decline from $86,000 to $78,711 triggered a domino effect in the markets, forcing traders to close positions due to margin calls.

- Analysts suggest that the reduction in leverage could mark a turning point for Bitcoin’s recovery if key support levels hold.

The cryptocurrency market has faced one of its most turbulent sessions of the year, with Bitcoin plunging to lows of $78,000, triggering over $827 million in long position liquidations. This sharp adjustment has shaken investor confidence, but some experts see this scenario as a buying opportunity before a potential rebound, especially if institutional demand increases and macroeconomic conditions become more favorable in the coming weeks.

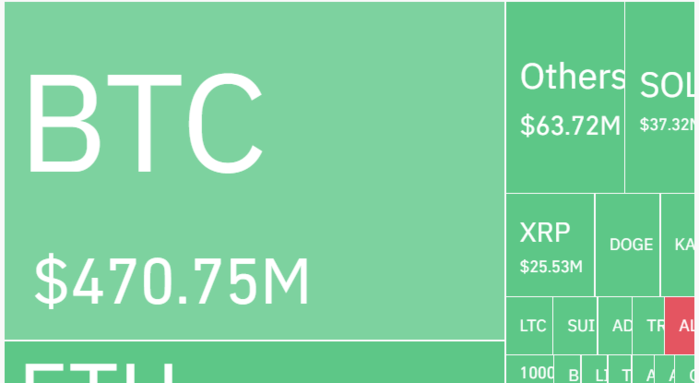

According to data from Coinglass, over 228,000 traders were affected by the liquidations, significantly reducing the market’s leverage levels. The selling pressure intensified after Bitcoin broke below the crucial $85,000 support level, causing a cascade of forced sell orders. While these corrections increase short-term uncertainty, they have historically helped eliminate “weak hands” and strengthen long-term investor positions.

The impact wasn’t limited to Bitcoin. Other major cryptocurrencies, including Ethereum and Solana, also suffered significant losses, with ETH hitting an annual low and seeing millions in liquidations. The sell-off also affected trading volumes on derivatives platforms, suggesting a temporary decline in speculative interest. However, some analysts believe that this leverage wipeout could pave the way for a more sustainable recovery in the coming weeks.

Market Crash or a New Buying Opportunity?

Despite the great panic in the markets, some analysts argue that this leverage purge could be beneficial for the crypto ecosystem. Lower leverage levels allow for a more stable recovery, reducing the risk of further liquidations in case of price rebounds.

Ethereum also saw significant losses, hitting a yearly low with over $217 million in liquidations. However, similar corrections in the past have often been followed by strong recoveries, especially during bullish cycles.

From a technical perspective, indicators such as the RSI entering oversold territory and the MACD turning negative suggest that the market might be nearing a point of seller exhaustion. If Bitcoin manages to stabilize within the $75,000-$78,000 range, some analysts predict a rebound towards the $90,000 level in the coming weeks.

While fear grips some investors, seasoned traders see this drop as a fresh opportunity to position themselves before the next major upward move.