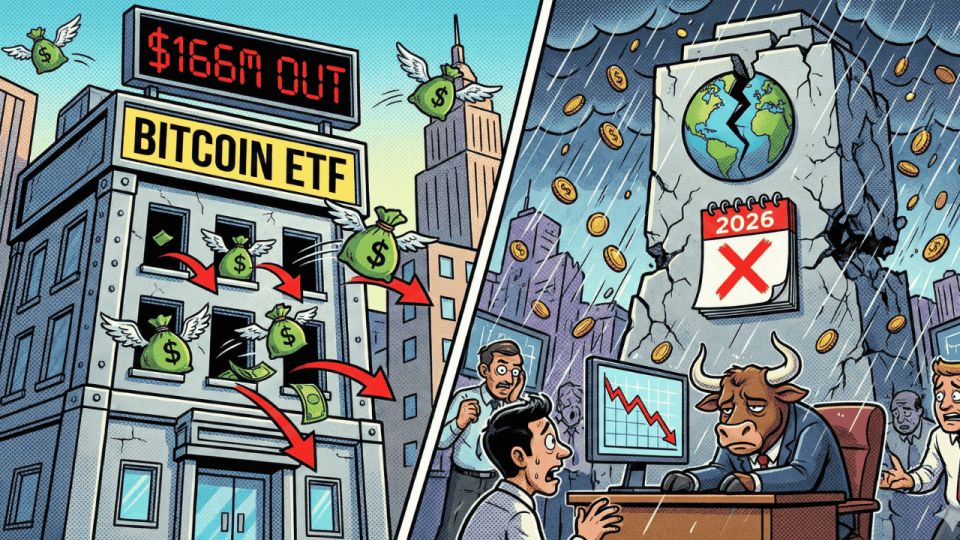

Spot Bitcoin ETFs suffered outflows of $165.8 million this Thursday, accumulating withdrawals of $2.7 billion so far this year according to primary market data. This trend, driven by a 21% reduction in trading volume, places the asset in its worst historic yearly start under the scrutiny of institutional investors.

The current capitulation reflects demand fatigue, as funds approach a five-week streak of negative flows. Trading activity has fallen to minimum levels not seen since December of last year, suggesting a strategic retreat of strong hands in the face of a macroeconomic scenario that fails to offer clear signals of expansion.

The post-halving cycle anomaly challenges institutional growth projections

This 22% drop in the price of Bitcoin during the first fifty days of the year represents a significant statistical deviation from previous cycles. When contrasting this data with specialized institutional research, it is observed that Bitcoin usually trades between three and ten times above its halving levels two years after the event; however, in 2026, the price remains stagnant.

The structural impact is visible in BlackRock’s iShares Bitcoin Trust (IBIT), which led weekly losses with $368 million in net outflows. This behavior is unusual for the world’s largest fund, especially when large asset managers have drastically reduced exposure in an operational manner, as is the case with Brevan Howard, which cut its position by 85% during the previous quarter.

The blockchain network has maintained its technical integrity, but market sentiment has been weighed down by the absence of a real supply shock following the 2024 halving. While in 2018 the market experienced a similar correction, the magnitude of outflows in regulated products in 2026 sets a new record of weakness for a fiscal year start.

Does this capital exodus indicate a definitive capitulation of the institutional investor?

The correlation between falling ETF flows and BTC price weakness highlights the market’s current dependence on Wall Street financial vehicles. Upon reviewing official documents filed with regulators, it is detected that the lack of new capital inflows is forcing a technical rebalancing that could prolong the current lateral-bearish consolidation phase.

For the coming months, it will be decisive to observe if the psychological support level of $60,000 manages to contain the selling pressure derived from fund redemptions. The market awaits a reversal signal in the daily flows of major issuers, a milestone that would mark the end of this unusual period of institutional disinterest in the digital asset.