TL;DR

- Nearly $10 billion has flowed into Bitcoin ETFs since Trump’s victory, boosting total assets under management to around $113 billion.

- Trump has changed his stance on cryptocurrencies, appointing a pro-crypto leader for the SEC and backing the creation of a national Bitcoin strategic reserve.

- Bitcoin surpassed $100,000, but volatility has generated uncertainty, while Ethereum has outperformed BTC in performance and attracted $2 billion in funds.

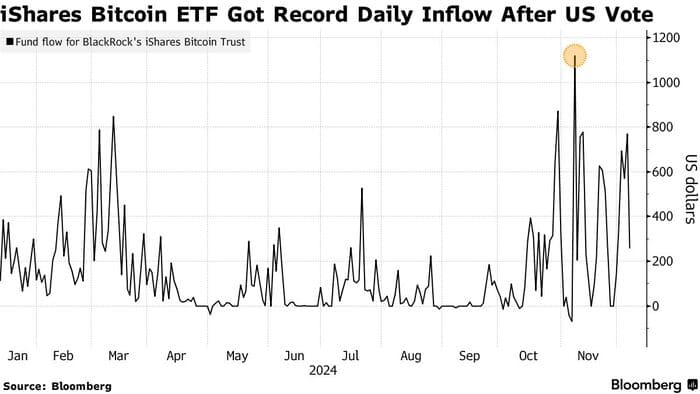

Nearly $10 billion has been invested in Bitcoin exchange-traded funds (ETFs) since Donald Trump was elected president, consolidating a shift in expectations regarding the future of cryptocurrencies under his leadership.

In total, ETFs from issuers such as BlackRock and Fidelity have received approximately $9.9 billion in net inflows since the November 5 election, raising the total assets of these funds to around $113 billion, according to data.

Trump, who was once very skeptical of cryptocurrencies, has made a 180-degree turn in his stance after appointing a pro-crypto leader to head the U.S. Securities and Exchange Commission (SEC). Additionally, he appointed a “czar” for artificial intelligence and cryptocurrencies at the White House.

A New Role for Bitcoin in the U.S. Economy

The president-elect has promised to change the outgoing Biden administration’s attitude toward cryptocurrencies by adopting and promoting more favorable regulations. Furthermore, Trump has supported the proposal to establish a national strategic Bitcoin reserve, which could accelerate market growth and trigger a surge in BTC demand.

Bitcoin’s price surpassed $100,000 for the first time on December 5, currently trading near $99,000. The cryptocurrency has maintained a streak of six consecutive weeks of gains, the longest since the market’s peak in 2021. However, volatility quickly followed, and Bitcoin’s price could start to decline. This has generated uncertainty about its short-term outlook. Some analysts warn that for BTC to sustain prices above $100,000, more positive factors will need to materialize in the near future.

On the other hand, investment funds in Ethereum have also experienced significant growth. After the approval of ETFs for this cryptocurrency, nearly $2 billion in net subscriptions have accumulated. Moreover, Ethereum has recently outperformed Bitcoin in terms of performance.