TL;DR

- Bitcoin’s rally did not generate the expected enthusiasm in the institutional market, with flows into ETFs dropping 67%.

- Despite net inflows of $600 million into BTC funds, investors are taking a cautious approach and waiting for more stability.

- The derivatives market shows signs of optimism, with a 2% increase in open interest in BTC futures and more activity in call contracts.

Bitcoin’s (BTC) rally, which saw it surpass the $100,000 mark for the first time since February, failed to generate the expected level of excitement in the institutional market.

Fund flows into Bitcoin-backed ETFs dropped by 67% compared to the previous week. Instead of spurring an increase in institutional investments, Bitcoin’s rise appears to have prompted investors to pause, preferring to wait and see if the price can hold above this new threshold.

Last week, Bitcoin funds saw net inflows of $600 million, a considerable amount but well below the $1.81 billion recorded the previous week. The decline in investment flows clearly reflects the prevailing caution in the market. While many investors remain interested in Bitcoin’s potential, they are adopting a more conservative stance, waiting for confirmation that the price can remain stable and above $100,000.

Bitcoin Shows Strength: What Do Investors Want?

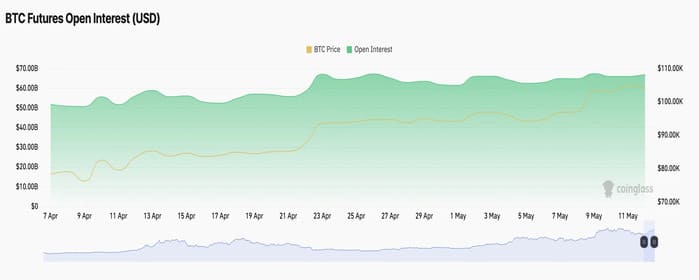

In contrast, the derivatives market shows signs of greater confidence. Bitcoin’s price is currently at $103,000, with virtually no change in the last 24 hours. However, what stands out is the increase in open interest for BTC futures, which has risen by 2%, reaching $67.04 billion. This suggests that more traders are participating in the market, pointing to a bullish trend. Additionally, the funding rates in the market remain positive, indicating that investors are still betting on a price increase for BTC.

A shift in behavior is also seen in the options market, where call contracts are outnumbering puts, signaling that most traders are expecting further bullish moves. Despite the decline in ETF flows, these derivatives market indicators suggest that overall sentiment remains positive.

The coming days will be crucial in determining whether Bitcoin can maintain its value above $100,000, which could reignite institutional interest in its ETFs.