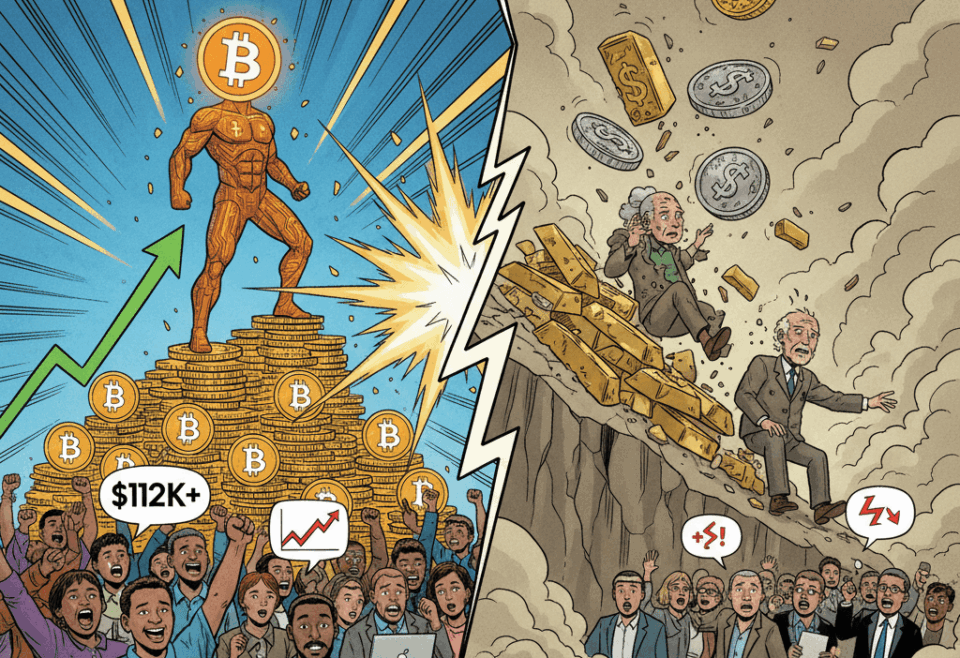

The cryptocurrency market awakens to a significant milestone this October 21st. Bitcoin surpasses $112,000 for the first time, reaching a new all-time high. This upward movement surprisingly coincides with a sharp drop in precious metals markets. Gold and silver experienced massive sell-offs. The information was highlighted by Bloomberg analysts, who noted a “capital flight” from traditional safe-haven assets.

The trading day showed a notable bifurcation in asset behavior. Bitcoin (BTC) registered an increase of over 9% in the last 24 hours. Its price consolidated firmly above the psychological $112,000 mark. This rally was driven by a spot trading volume exceeding $70 billion. Simultaneously, gold fell 4.5%, breaking the key support of $2,100 per ounce. Silver suffered even more, plummeting 6% and losing its $25 level.

This event marks a possible break in the historical correlation between Bitcoin and gold. Traditionally, both were seen as hedges against inflation and global economy uncertainty. However, today’s behavior suggests a shift in investor perception. Capital seems to prefer the digital agility of the crypto asset. Analysts suggest that recent regulatory clarity in the U.S. has strengthened confidence in BTC, now viewing it as a superior asset.

Is this the definitive decoupling of cryptocurrencies?

The reaction of the digital market has been euphoric. This new BTC high could trigger a new “altseason”. Investors are now watching if capital will flow into Ethereum and other altcoins. For precious metal holders, the situation is highly tense. Gold’s sharp decline calls into question its role as the primary store of value in the digital age. The “digital gold” narrative for Bitcoin is stronger than ever. If this trend continues, we could be witnessing a generational capital reallocation.

Bitcoin is consolidating in a new price range, leaving traditional assets behind in today’s session. The strength demonstrated by the digital asset redefines investment strategies. The next few days will be crucial to observe if metals manage to regain ground. Meanwhile, the crypto sector watches if Bitcoin surpasses $112,000 sustainably. The debate over the true safe-haven asset of the 21st century is at its peak.