TL;DR

- Bitcoin ETFs listed in the U.S. continue attracting institutional investments, with a total net inflow of $115 million despite recent market volatility.

- BlackRock’s iShares Bitcoin Trust (IBIT) stands out with $410 million in daily inflows, solidifying its dominance in the market.

- Bitcoin’s price rose nearly 1%, and futures open interest showed a slight increase, reflecting a cautiously optimistic sentiment.

Institutional investors keep showing strong interest in U.S.-listed Bitcoin ETFs, confirming the growing adoption of this digital asset within traditional financial markets worldwide. Although the total net inflow on Thursday was $115 million—a lower figure than the previous day—it still demonstrates sustained confidence in this emerging asset class. BlackRock emerges as the clear leader, with its iShares Bitcoin Trust (IBIT) recording net inflows exceeding $410 million, pushing the fund’s total assets under management beyond $64 billion, surpassing even traditional gold ETFs and highlighting a major shift in institutional priorities.

Institutions Strengthen Their Preference For Bitcoin

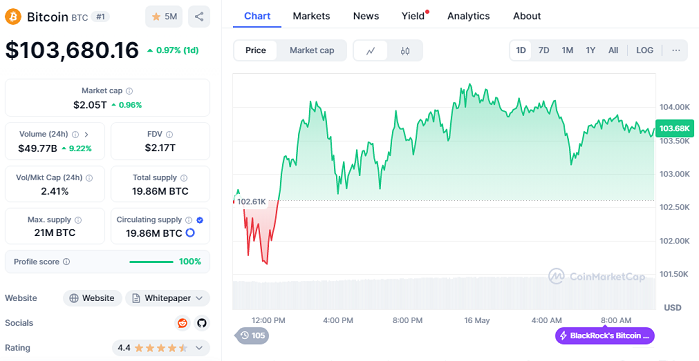

The steady increase in capital inflows to IBIT indicates that major investors, including leading investment banks like Goldman Sachs, are expanding their exposure to Bitcoin, viewing it as a digital safe haven against inflation, currency devaluation, and growing economic uncertainty. This trend coincides with a rebound in Bitcoin’s price, which climbed approximately 0.97% in the last 24 hours, reaching around $103,680. This modest rise, combined with a 1% increase in futures open interest, suggests that while the overall trend is bullish, investors remain cautious, maintaining a good balance between optimism and risk management.

BlackRock Drives Crypto Expansion With Competitive Strategy

IBIT’s success can be partly attributed to its low management fee—only 0.25%—and the strong brand trust it commands, making it highly attractive to institutional investors seeking Bitcoin exposure without excessive risk. Analysts note that this preference may also be driven by sophisticated hedging and trading strategies employed by large funds capitalizing on market fluctuations.

In a regulatory environment that is gradually evolving and becoming clearer, BlackRock’s leadership could be pivotal in accelerating cryptocurrency integration into global financial markets, fostering innovation, and increasing confidence in the digital asset ecosystem.

The continuous flow of institutional capital and strengthening futures interest indicate a market that is consolidating and growing steadily. As adoption expands and regulatory clarity improves, we are likely to see a significant boost in confidence and usage of Bitcoin as a core asset within global investment portfolios, paving the way for a new era of financial innovation powered by cryptocurrencies.