TL;DR

- Michael Saylor, executive chairman of MicroStrategy, discussed the theoretical possibility of an 80% Bitcoin crash, though he considers it highly unlikely.

- Saylor shared insights into MicroStrategy’s strategy of regularly purchasing Bitcoin, resulting in substantial profits and a Bitcoin-based yield of 63.3% for shareholders.

- He highlighted that previous crashes were driven by the collapse of poorly managed companies, but the current market lacks such vulnerable players, making a similar crash less likely.

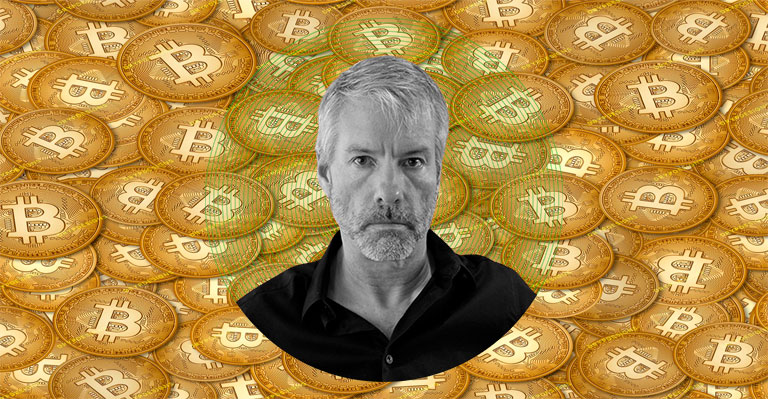

In a recent interview with Yahoo Finance, Michael Saylor, the executive chairman of MicroStrategy and a well-known Bitcoin advocate, discussed the possibility of an 80% crash in Bitcoin‘s value. While Saylor emphasized that this scenario is highly unlikely, he acknowledged that it remains a theoretical possibility.

This revelation has sparked discussions within the cryptocurrency community about the potential risks and future of Bitcoin.

On $BTC 100K Day, my discussion with @JulesHyman covered advice to @stoolpresidente, cyber-manhattan, the need for a digital assets framework, the emergence of #Bitcoin as the world reserve capital network, and the logic of a US Strategic #Bitcoin Reserve. pic.twitter.com/XG9uChRap8

— Michael Saylor⚡️ (@saylor) December 6, 2024

Saylor’s Bitcoin Accumulation Strategy

During the interview, Saylor shared insights into MicroStrategy’s Bitcoin strategy, which involves regular purchases of the cryptocurrency regardless of market volatility. Over the past two years, MicroStrategy has raised capital through debt and issuing shares to buy more Bitcoin.

This approach has resulted in the company accumulating approximately 402,100 BTC at an average price of $58,219 per coin. Saylor highlighted that this strategy has delivered substantial profits, with a Bitcoin-based yield of 63.3% for shareholders, translating to $12.3 billion in returns for the year so far.

Factors That Could Trigger a Crash

Saylor addressed the potential factors that could lead to a significant Bitcoin drawdown. He pointed out that previous crashes, such as the one from $66,000 to $16,000 in 2022, were driven by the collapse of poorly managed companies like FTX, Celsius, and Genesis.

These companies’ failures created a ripple effect, leading to massive sell-offs and market instability. However, Saylor noted that the current market landscape lacks such vulnerable players, making a similar crash less likely.

Market Sentiment and Future Outlook

Despite the theoretical risk of an 80% crash, Saylor remains optimistic about Bitcoin’s long-term potential. He believes that Bitcoin’s value will continue to grow as more investors recognize its benefits as a store of value and hedge against economic instability.

Saylor’s confidence in Bitcoin is reflected in his personal investment strategy, as he continues to buy Bitcoin regularly to add to his holdings. While Michael Saylor acknowledges the possibility of a massive Bitcoin crash, he considers it an unlikely scenario given the current market conditions.

His continued investment in Bitcoin and the success of MicroStrategy’s strategy underscore his belief in the cryptocurrency’s long-term potential. As the market evolves, investors will need to remain vigilant and consider both the risks and opportunities associated with Bitcoin.