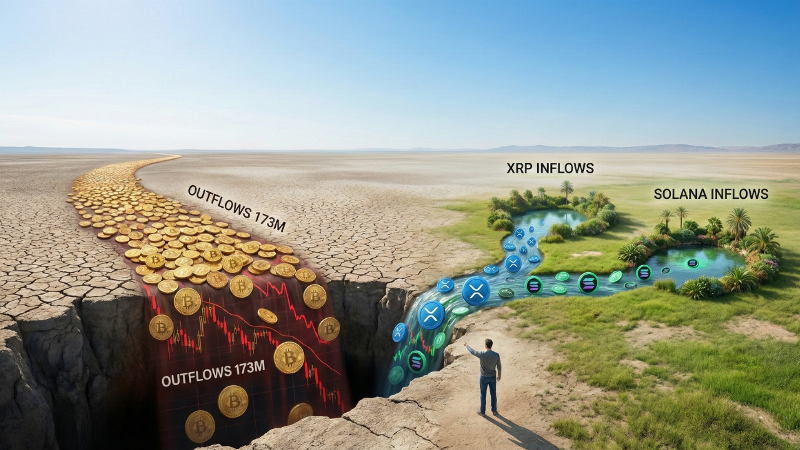

Institutional caution deepens for the fourth consecutive week, resulting in net outflows of $173 million, according to data breakdown in the latest weekly report from CoinShares. Although the volume of selling has moderated compared to January highs, Bitcoin and Ethereum lead the massive capital withdrawals in an environment marked by macroeconomic uncertainty and the volatility of inflationary data.

From this perspective, the balance of the last four weeks reflects a scenario of structural risk aversion, totaling losses of $3.74 billion for the month, a figure that underscores the fragility of current investor sentiment. Simultaneously, transactional activity has cooled drastically, evidenced by a drop in trading volumes of investment products to $27 billion, far from the previous record of $63 billion, denoting a necessary tactical pause.

Regional divergence and global strategic accumulation

When analyzing the geography of flows, the United States stands out as the indisputable negative catalyst, where outflows amounting to $403 million were recorded, canceling out the positive inflows observed in other global jurisdictions. This behavior suggests that, while US investors capitulate to regulatory pressure, institutions in other markets are taking advantage of price weakness to accumulate strategic long-term positions, creating a clear regional divergence.

On the other hand, and despite the gloomy outlook for market leaders with Bitcoin losing $133 million, there is a capital rotation towards assets with specific fundamentals. In a counter-cyclical move, XRP and Solana captured 33.4 and 31 million respectively, demonstrating that institutional appetite for alternative cryptocurrencies remains valid and selective, as managers are not abandoning the sector, but readjusting their portfolios towards assets with greater potential.

Do derivatives signal an imminent market bottom?

Additionally, a relevant technical indicator is the behavior of bearish derivative products, given that Short Bitcoin funds suffered outflows of 15.4 million, a phenomenon that historically tends to coincide with phases of capitulation and seller exhaustion. This data, often ignored, could signal that the market is near a local bottom, as the decrease in interest in betting against Bitcoin’s price suggests that bearish investors are taking profits in anticipation of a rebound.

Finally, the end of the week offered significant respite when the CPI data from the Bureau of Labor Statistics came in softer than expected, catalyzing late inflows of $105 million on Friday. This sudden turn confirms that the market’s sensitivity to macroeconomic indicators remains extremely high, and that any sign of relief in monetary policy has the capacity to reverse the flow trend immediately.

Looking ahead, the moderation in the pace of outflows suggests that the sharpest phase of liquidation may have concluded, giving way to a period of stabilization. It will be crucial to monitor whether the divergence between US capital and the rest of the world persists in upcoming reports, as well as the ability of altcoins to sustain their appeal against a Bitcoin seeking to consolidate its vital support.