TL;DR

- A whale investor placed a $27 million leveraged bet on PEPE with 10x leverage, now teetering on the edge of liquidation after a sharp price drop.

- Another major holder sold 438 billion PEPE tokens, incurring a $434,000 loss and increasing downward pressure on the market.

- Despite widespread fear, this could be seen as an opportunity for bulls if this is a final capitulation and the price bounces from oversold territory.

The crypto world never ceases to surprise. A whale-level trader has taken one of the boldest positions of the year, betting $27.53 million on PEPE using 10x leverage via the Hyperliquid platform. The entry price was $0.00814 per 1,000 PEPE, but the market moved against them, generating $3.2 million in unrealized losses.

To avoid automatic liquidation —which would be triggered if the price falls to $0.005219— the investor added an extra $3.8 million in margin. This move shows a strong belief in the asset’s recovery, though it also highlights the extreme pressure involved in high-leverage trading. However, many crypto ecosystem experts consider these kinds of trades an inherent part of the digital asset market, where risks are high, but rewards can be even higher. Even if the outcome is negative, the experience and exposure generated by such events contribute to the market’s maturity. Moreover, it demonstrates the growing institutional interest and the role whales play in shaping the narrative around speculative tokens like PEPE. These episodes also reflect how liquidity depth and tokenomics design can significantly affect market behavior under stress conditions.

Massive Sell-Off Adds Pressure: A Hidden Opportunity?

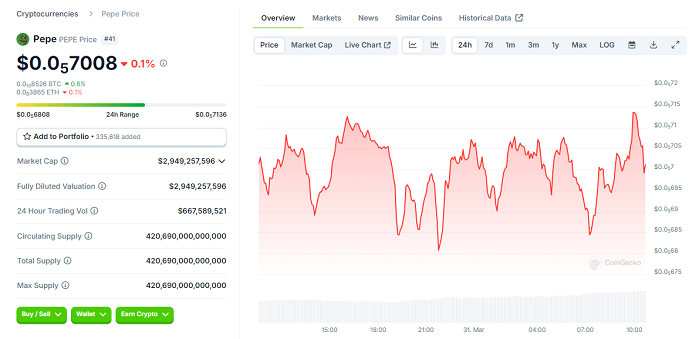

As if things weren’t tense enough, another major holder dumped 438 billion PEPE tokens, worth $3.03 million, at a $434,000 loss. This sale pushed PEPE back below all key moving averages (EMA 50, 100, and 200), reversing all the momentum it had recently gained. With the RSI at 41.89, the token is nearing oversold territory, although a technical rebound is not guaranteed. PEPE is currently trading at $0.0570, down 0.1% over the past 24 hours.

Since February, PEPE has been following a bearish structure with lower highs and lower lows, which raises concerns about its medium-term stability. However, in the crypto world, the biggest crashes often precede explosive rebounds. For many pro-crypto analysts, these types of events represent prime capitulation zones, perfect for strategic entries—especially in meme coins that thrive on media attention.

While traditional markets fear volatility, in the crypto universe, risk is part of the game. And although PEPE’s immediate future is uncertain, one thing is clear: the big trades are far from over.