TL;DR

- Ethereum sets a record in futures, with over $20 billion in open interest on perpetual contracts, reflecting significant growth in the use of leverage.

- Despite the recent price consolidation, the crypto market continues to show growing confidence in ETH.

- Ethereum’s market capitalization has reached $331.46 billion, reaffirming its central role in the ecosystem.

Ethereum is experiencing a period of great dynamism in the derivatives market, achieving a new all-time high in cash-margined futures open interest, which has surpassed $20 billion. This figure, highlighted by the on-chain analytics platform Glassnode, reflects a renewed boom in the use of leverage among traders, even as the price of ETH remains near $2,800.

This growth in futures interest is happening in a relatively stable price environment, indicating greater structural participation by traders. Unlike previous years, more funds are now backed by cash rather than crypto margins, signaling a growing interest from both institutional and retail investors supported by stablecoins. The trend of traders opting to use stablecoins for exposure to ETH in futures contracts highlights a shift toward higher risk tolerance and a belief in the continued strength of the Ethereum network.

Increasing Leverage: Signs of a Stronger Market

The rise in the use of perpetual contracts with cash margins shows that institutions and retail investors are adopting a more active stance in Ethereum derivatives. With open interest reaching historic levels, many speculate on the future direction of ETH prices, with most agreeing that the market seems now ready for a rally towards $4,000, though some caution about the risks of a correction if long positions become too concentrated.

Ethereum and Its Position in the Crypto Market

The highlight of this increase in Ethereum futures is that, despite the price consolidation, the cryptocurrency has outperformed Bitcoin in recent weeks, with an appreciation of 108% since early April. The ETH/BTC ratio has risen by 50%, further raising investor expectations.

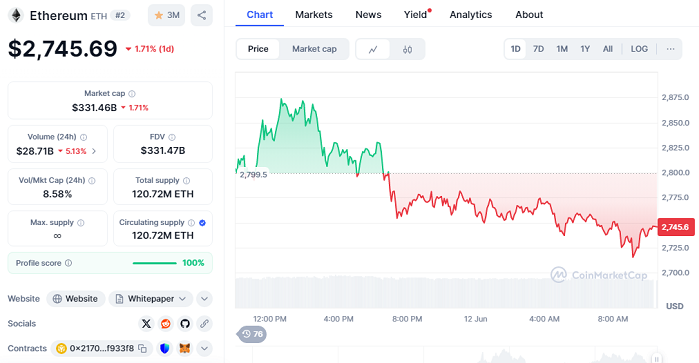

With a market capitalization of $331.46 billion and a current price of $2,745.69, Ethereum continues to demonstrate its resilience. Despite a slight 1.71% pullback in the last 24 hours, the trading community maintains an optimistic outlook, especially with the “cup and handle” technical pattern that could propel ETH price to $4,200 in the near future.

Now, all eyes will be closely watching whether this financial leverage will ultimately drive further gains or set the stage for a potential market correction.