TL;DR

- Gemini, led by the Winklevoss twins, announced a boycott of MIT graduates due to the university’s association with former SEC chair Gary Gensler.

- The ban also excludes MIT students from Gemini’s summer internship program.

- The move is a response to Gensler’s history with the SEC, marked by regulatory actions against the crypto sector.

The relationship between the cryptocurrency industry and former SEC chair Gary Gensler continues to fuel tensions. Following Gensler’s return to MIT as a professor teaching artificial intelligence in finance and regulation, the cryptocurrency exchange Gemini made a bold decision: it will not hire MIT graduates as long as Gensler remains affiliated with the institution.

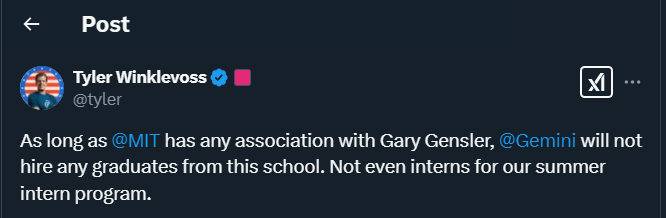

Tyler Winklevoss, co-founder and CEO of Gemini, confirmed this stance in a post on X (formerly Twitter), emphasizing that the move aims to send a clear message in defense of the crypto industry. He also clarified that MIT students will not be considered for the company’s summer internship programs.

The decision stems from the ongoing conflict between Gemini and the SEC, which reached its peak in 2023 when the company paid $21 million in fines related to its Gemini Earn program. The SEC accused the program of offering unregistered securities in collaboration with the now-bankrupt Genesis firm. These actions were spearheaded by Gensler during his tenure as SEC chair.

A Divided Industry

Gemini’s decision has sparked mixed reactions within the crypto community. While prominent figures like Bitcoin advocate Erik Voorhees support the boycott, others argue that it is disproportionate. Sergey Gorbunov, co-founder of Axelar Network, contended that students should not be punished for the actions of one professor and even extended an offer to hire MIT graduates.

Others, such as Preston Byrne of Arkham, noted that avoiding law firms tied to former SEC officials is reasonable, but banning all graduates from a university is extreme. An alternative approach was suggested by Jiasun Li, a professor at George Mason University, who proposed limiting the boycott to students directly involved in Gensler’s classes.

Gemini’s stance reflects the crypto sector’s resentment toward Gensler’s regulatory policies, which are seen as hostile to the industry’s development. Although the SEC is now under the leadership of Mark Uyeda, the industry hopes for a more favorable regulatory landscape, especially after the recent approval of Bitcoin ETFs.

Gemini’s bold move serves as a reminder of the significant impact regulatory decisions have on trust and the future of the tech and financial sectors. However, it also raises ethical questions about how to address these tensions without unfairly affecting third parties.