Since the emergence of the Decentralized Finance (DeFi) sector, nearly $60 billion has been lost due to hacks and exploits.

A considerable portion of these losses are attributed to economic exploits, and unlike technical risks, economic risk mitigation tools have been mostly non-existent.

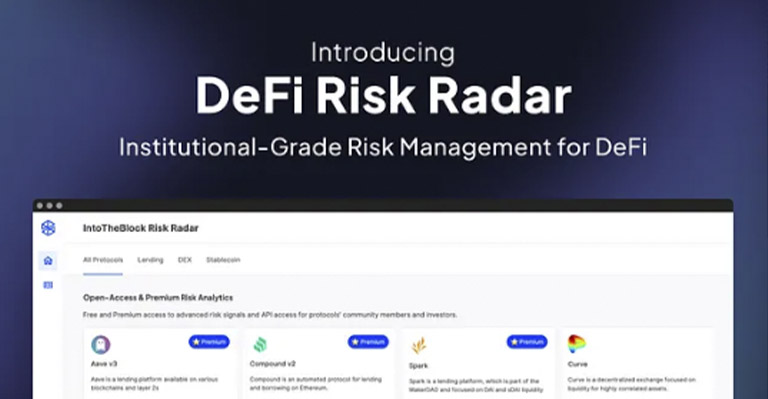

However, IntoTheBlock has excitedly announced the full launch of the “DeFi Risk Radar”, a comprehensive solution designed to mitigate billions in losses from insufficient economic risk management in DeFi.

This industry-first product promises enterprise level risk management and has been developed after a year of extensive testing and extensive collaborations with industry partners.

With initial coverage for 9 major protocols, including Aave, Compound, Spark, Curve, Aave Gho, Benqi, Moonwell, Tashi and Euler, the DeFi Risk Radar offers economic risk metrics tailored to each protocol, providing specific information and concrete actions.

DeFi Risk Radar stands out thanks to its remarkable level of detail in data management, using detailed analysis carried out block by block to carry out an accurate assessment of risks.

This approach allows for a comprehensive understanding of economic conditions in the DeFi space, providing detailed and up-to-date information on each transaction block.

This level of granularity ensures that the tool provides an extremely accurate and specific view of the risks involved, allowing users to make informed and strategic decisions in real time.

Facilitates seamless integration and access to DeFi data through an API and CSV data functionality

The benefits for users are obvious: access to unique information on economic risks to make informed decisions based on individual risk tolerance.

Additionally, data-driven protection is comparable to that used by the largest institutions in the crypto space.

Block-by-block visualizations provide key insights through intuitive dashboards, facilitating efficient and fast decisions.

Risk dashboards are protocol-specific and use a variety of indicators to monitor and manage the health and stability of the protocols.

Indicators include the Liquidators Leaderboard, Loan Health Factor distributions, net liquidity flows, whale activity tracking, recursive lending insights, and more.

IntoTheBlock, recognized as a key partner for numerous institutions in the cryptocurrency industry, has developed the DeFi Risk Radar based on its experience and in collaboration with leading DeFi protocols.

To learn more, access premium protocols, participate in live demos, and understand how DeFi Risk Radar can protect your investments, interested parties are encouraged to contact IntoTheBlock.

Additionally, a webinar is scheduled for January 17, 2024, where the evolution of risk in DeFi will be explored.