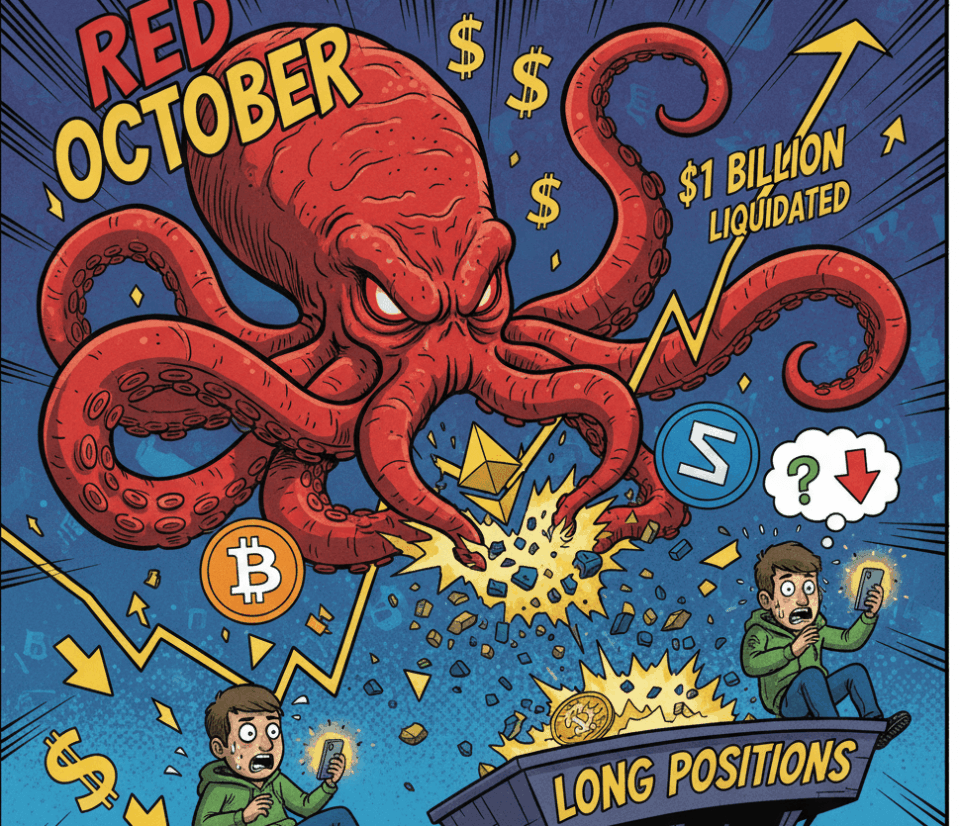

The cryptocurrency market recently experienced one of its sharpest downturns, with over $1 billion in leveraged positions liquidated within a 24-hour period. This event primarily affected traders who were betting on price increases for assets like Bitcoin, Ethereum, and Solana. The primary source for this data, the analytics platform CoinGlass, confirmed the extent of the losses.

The hard data reveals the severity of the market correction. During the massive sell-off, Bitcoin (BTC) suffered the brunt of the losses, with hundreds of millions in long position liquidations. Ethereum (ETH) and Solana (SOL) followed closely, experiencing significant percentage drops in their prices that erased the gains accumulated during the traditionally bullish month known as “Uptober.” More than 300,000 traders were liquidated across various exchange platforms.

Why did this sudden drop occur?

This drastic market movement is attributed to excessive leverage by retail investors and macroeconomic volatility. As asset prices began to fall, a cascade of automatic liquidations was triggered, which exacerbated the selling pressure. This phenomenon highlights the inherent risks of margin trading in such a volatile ecosystem, directly and immediately affecting the digital economy. Investor confidence was notably shaken.

A healthy correction or the start of a bigger drop?

The immediate impact of these crypto market liquidations is an increase in the sentiment of fear and caution among investors. The sharp drop below key support levels for Bitcoin and Ethereum could indicate the beginning of a deeper corrective phase or, conversely, a necessary purge to clear out excess leverage before a new push. Analysts are closely watching to see if prices will manage to stabilize in the coming days.

This event serves as a clear reminder of the unpredictable nature of digital asset markets and the importance of proper risk management. Market participants are now wondering if the anticipated “Uptober” has come to a premature end or if this correction is merely a pause in a longer-term uptrend. The price action in the coming weeks will be crucial for determining the future direction.