TL;DR

- Richard Teng, CEO of Binance, states that the crypto market’s drop is temporary and not a structural change, highlighting that the sector will recover quickly.

- The drop in Bitcoin, triggered by Trump’s tariff confirmation, is not indicative of a permanent decline; the market shows extreme fear, but this is a common response to uncertainty.

- Teng emphasizes the growing interest in crypto ETFs and the cautious stance of the U.S. Federal Reserve, which favors demand for riskier assets like cryptocurrencies.

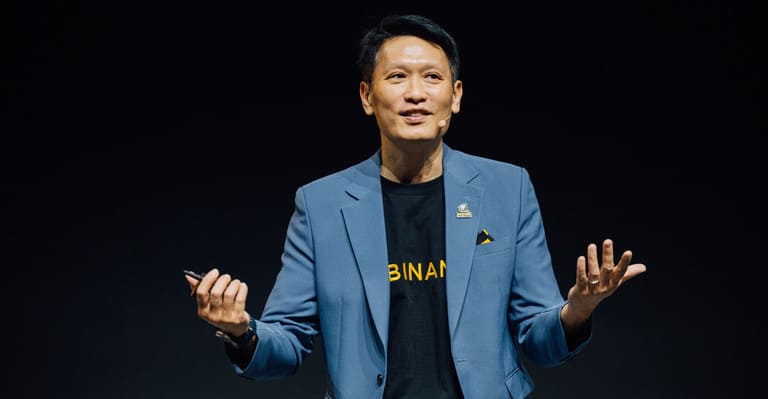

The crypto market has experienced a sharp drop, but according to Richard Teng, CEO of Binance, this slowdown is only temporary and not a structural change.

Teng assured that this volatility, caused by macroeconomic factors, is nothing new for the sector, and the crypto market tends to recover quickly from such episodes. He highlighted that the current situation should be interpreted as a “tactical retreat” rather than a reversal in the market trend.

Here's my thoughts on the recent market turbulence: It's important to view this as a tactical retreat, not a reversal.

Crypto has been here before and bounced back even stronger. Here's why we should stay optimistic. ⤵️

A thread 🧵

— Richard Teng (@_RichardTeng) February 25, 2025

The Trump Factor

Bitcoin’s drop to nearly $85,000 occurred after U.S. President Donald Trump confirmed that tariffs on Mexico and Canada would proceed. However, Teng stated that these types of fluctuations are common and do not indicate a permanent decline in the value of cryptocurrencies. Despite the drop, market sentiment indicators like the Crypto Fear & Greed Index show extreme fear, but Teng also emphasized that this is normal behavior during uncertain times.

Richard Teng Emphasizes the Strength of the Crypto Market

Richard Teng also pointed out that the U.S. Federal Reserve has taken a more cautious approach to interest rate cuts, which has influenced market turbulence. Lower interest rates are usually favorable for cryptocurrencies since investors tend to seek riskier assets when returns on traditional assets like bonds are lower.

Another positive for the sector is the growing interest in crypto exchange-traded funds (ETFs). Richard noted that the demand for these products is rising, reflecting the market’s strength. In particular, there have been applications to launch ETFs linked to assets like XRP, Cardano, Solana, and Dogecoin in the U.S., meaning cryptocurrencies continue to attract institutional investors.

Despite the short-term drop, the crypto market continues to demonstrate a great capacity for recovery. Advances in the creation of new products and the stability of the market fundamentals suggest that the sector will continue to strengthen in the long term.