TL;DR

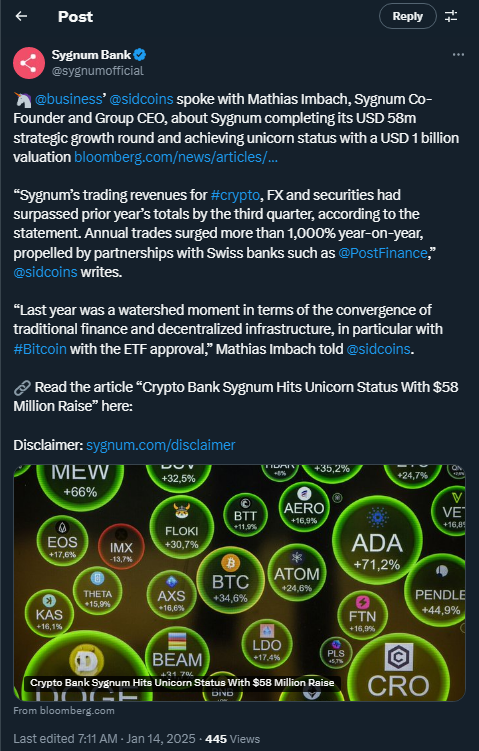

- Sygnum Bank has raised $58 million, reaching a valuation of over $1 billion.

- The funds will be used to expand its product portfolio, focusing on Bitcoin technology.

- The bank plans to expand its regulated presence in Europe and Asia, as well as strengthen its compliance teams.

Swiss-Singaporean bank Sygnum has achieved a significant milestone by reaching a valuation of over $1 billion after completing a $58 million strategic funding round. This fundraising was led by Fulgur Ventures, a venture capital firm specializing in Bitcoin-related technologies, which was the main investor. Other strategic and financial investors also joined, along with participation from Sygnum team members.

With this investment, Sygnum has set several short- and medium-term goals, with the primary one being the expansion of its product portfolio, particularly focusing on Bitcoin-related technologies. The bank will also strengthen its institutional infrastructure, enhance its compliance teams, and explore strategic acquisition opportunities, all aimed at strengthening its position in a rapidly evolving market. Additionally, Sygnum will use part of the funds to expand its presence in the European Union and launch its regulated presence in Hong Kong, aiming to secure a significant share in emerging and developing markets.

Global Expansion and Increased Regulation

The bank already holds licenses in Switzerland and Singapore and has recently added regulations in Abu Dhabi, Luxembourg, and Liechtenstein. Its goal is to broaden its regulated footprint in the European Union, especially under the MiCA framework, which provides clear regulation for digital assets in Europe. Sygnum is convinced that this expansion is key to strengthening its business model and staying competitive globally, despite growing competition in other jurisdictions.

In addition to focusing on geographic expansion, Sygnum has achieved operational profitability in the 2024 fiscal year, driven by a 1,000% increase in its trading products, including cryptocurrencies, derivatives, and traditional securities. The bank currently manages over $5 billion in assets for more than 2,000 clients across 70 countries, consolidating its position as one of the most important banks in the crypto sector.

The Swiss bank has proven to be a key player in driving institutional adoption of cryptocurrencies, and it has also made an interesting prediction regarding Ethereum exchange-traded funds (ETFs). In 2025, Sygnum expects Ethereum to continue gaining ground, although at a slower pace than Bitcoin, generating between $5 billion and $10 billion in its first year.