TL;DR

- Today will see a massive expiration of Bitcoin and Ethereum options. Their combined value is $2.4 billion, with a potential impact on prices expected.

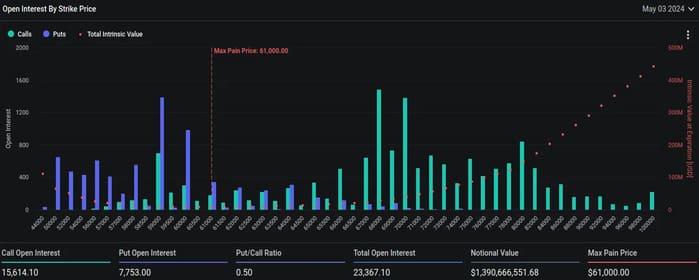

- BTC options contracts are worth $1.39 billion, with maximum pain at $61,000. ETH options equate to $1 billion, with maximum pain at $3,000.

- The crypto market experienced a 4% increase in the last 24 hours. BTC trades near $59,000, ETH near $3,050. Temporary volatility is expected after the options expiration.

The crypto market is awaiting the massive expiration of Bitcoin and Ethereum options today. With a combined notional value of nearly $2.4 billion, it’s believed to have a significant impact on BTC and ETH prices.

For Bitcoin, options contracts worth $1.39 billion are expected to expire. This volume is lower compared to the previous week, indicating a decrease in options trading activity. However, there’s a crucial point: the maximum pain price for BTC is at $61,000. This means that theoretically, this price level would cause financial losses for the largest number of investors.

On the other hand, Ethereum also faces the expiration of a large number of options contracts, approximately 334,248, with a notional value close to $1 billion. The maximum pain point for Ethereum is set at $3,000, which is the key price level to watch for options traders.

Crypto Market Expects Short-Term Volatility

Despite the uncertainty associated with options expiration, markets have experienced a 4% increase in the last 24 hours, bringing the total market capitalization to $2.32 trillion. Bitcoin continues to experience slight volatility, falling below $57,000 before recovering and settling around $59,000. Meanwhile, Ethereum has seen a 2.3% increase and is trading around $3,050.

While options expiration may generate short-term volatility in underlying asset prices, this impact tends to be temporary. Generally, the market stabilizes again after expiration and compensates for price fluctuations.

Although investors should be prepared for potential sharp movements in Bitcoin and Ethereum prices due to the massive options expiration. It’s essential to maintain a long-term perspective and understand that the volatility associated with this expiration is a natural part of the market.