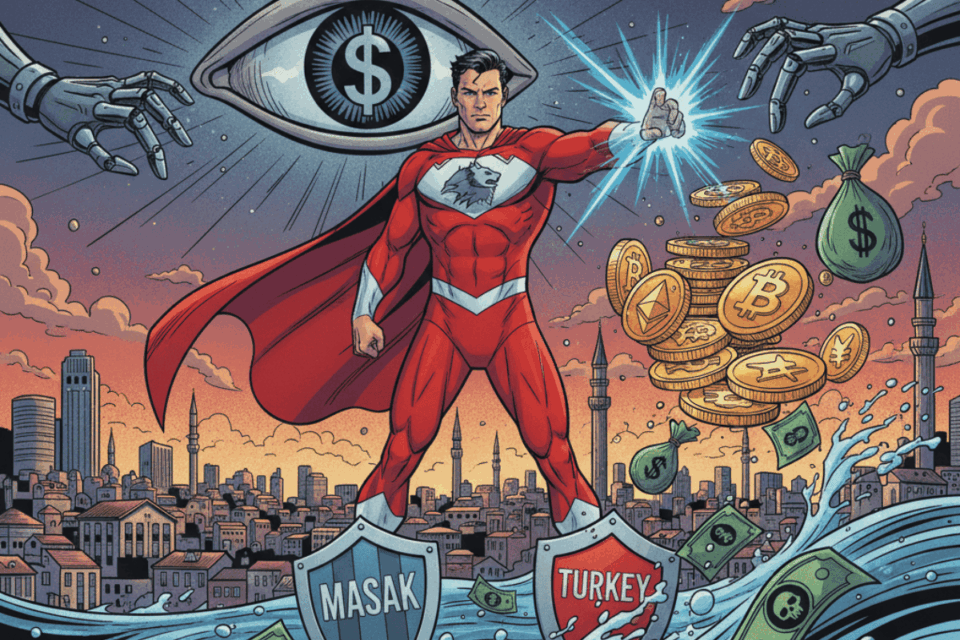

The Turkish government is moving forward with a new draft bill that will significantly expand the powers of its main financial watchdog. The measure aims to grant the financial intelligence unit, known as Masak, the authority to intervene in bank and cryptocurrency accounts linked to criminal activities, according to local reports.

The draft legislation proposes that Masak will be able to freeze assets and restrict transactions more swiftly. Specifically, the agency would gain new powers to act on suspicious accounts at banks, payment platforms, and crypto-asset exchanges. Furthermore, it will be able to blacklist digital wallet addresses to prevent their use within the country’s formal financial network.

New Powers for the Financial Intelligence Unit

The main objective of this cryptocurrency regulation in Turkey is to combat the use of “rental accounts.” This is a scheme where individuals give control of their banking credentials to third parties to facilitate fraud or illegal betting operations. With the new law, the goal is to dismantle these networks that exploit the financial infrastructure for illicit purposes.

This legislative initiative is part of the country’s broader effort to strengthen its controls against money laundering and terrorist financing. Although the main focus is on criminal activities, the measure will directly impact the digital asset technology ecosystem. The implementation of stricter controls could increase institutional confidence in the local market if applied with full transparency.

What Does This Mean for the Local Crypto Ecosystem?

The implications of this future law are twofold for the Turkish market. On one hand, cryptocurrency exchange platforms will face higher regulatory compliance costs to adapt to the new requirements. This pressure could incentivize some users to migrate towards decentralized alternatives that operate beyond the reach of local jurisdiction.

However, a clearer and more robust cryptocurrency regulation in Turkey could also attract institutional investors seeking security and defined rules. The market is at a crossroads, waiting to see how these new supervisory tools are implemented. The balance between security and operational freedom will be key to the future of the sector in the country.