TL;DR

- An influential whale identified as @aguilatrades closed its long position in Bitcoin and opened a short position with 20X leverage, signaling a strategic shift in response to the recent drop in BTC’s price.

- In the last 24 hours, liquidations worth over $451 million have been recorded across all exchanges, affecting notable traders.

- Despite the volatility, the Hyperliquid platform continues to maintain a high level of activity and liquidity, showcasing the ongoing interest of whales to capitalize on opportunities.

One of the most well-known Bitcoin whales, recognized in the community for its expertise and discretion, decided to exit its long position in BTC and bet on the downside with 20X leverage. This decision came after a loss of approximately $12.4 million in a 40X leveraged long position, reflecting the shift in strategy by some of the key players amid the recent decline in the cryptocurrency’s price.

On-chain data reveals that this trader, known as @aguilatrades, who rarely discloses their moves publicly, was recently detected by on-chain investigators. Their strategic shift coincided with the liquidation of other relevant traders, such as James Wynn, who also lost positions in a market that has seen over $1 billion in liquidations in the last 24 hours, with $451 million specifically in BTC pairs.

The Importance of Activity on Hyperliquid for Whales

While the price drop caused losses for traders with long positions, the Hyperliquid platform has continued to register activity and liquidity levels close to the highs reached in previous months. Hyperliquid has proven to be a space where whales remain very active, taking significant positions in native tokens like HYPE and other trending tokens, capitalizing on volatility to adjust their portfolios.

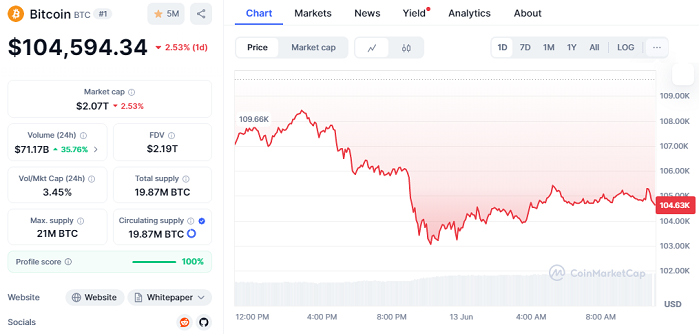

Currently, BTC is trading around $104,594, down 2.53% in the last 24 hours, with a market cap exceeding $2 trillion. The robust liquidity of USDC on Hyperliquid, which has surpassed $3.1 billion, reflects the confidence that large accounts maintain in the ecosystem, even in uncertain scenarios. Additionally, the expectation of a possible second airdrop on the platform is fueling activity, keeping the market dynamics in motion.

Pro-Crypto Perspectives in a Dynamic Market

Despite recent losses, the ability of whales to adapt and reconfigure their strategies demonstrates the maturity of the crypto market. Switching from long to short positions with high leverage allows traders to seize opportunities in both uptrends and downtrends, which is a positive sign for the evolution of professional trading in the digital space.

This behavior also indicates that the market remains attractive to institutional investors and big players, who value liquidity and the speed of platforms like Hyperliquid for moving large volumes without significantly impacting prices.