Cross-chain Swaps, also known as Atomic Swaps, are kinds of exchanges that make it possible to trade cryptocurrencies from different blockchains. In simple terms, these swaps let users trade their tokens for tokens that aren’t present in the first blockchain.

Using cross-chain swaps, we can expect faster trading and swap without the need to pay extra fees to move the tokens between blockchains.

The history of cross-chain swaps goes back to 2018 and a whitepaper written by Maurice Herlihy of the Department of Computer Science at Brown University Providence, named Atomic Cross-Chain Swaps.

There are currently numerous swaps of this kind in operation. Their main need is a cross-chain bridge that makes it possible to trade tokens between various blockchains.

Protocols and algorithms that make this kind of swap possible are gaining trust and attraction in the crypto industry. The current ones have specific pros and cons that make them unique and attractive.

What are Cross-Chain Swaps?

A cross-chain atomic swap makes it possible to trade cryptocurrencies directly between people without the limitations of source and destination blockchains.

There are no middlemen in this kind of trading. Thus, the process is like trading fiat currencies between two persons in traditional bankings. The process that makes cross-chain swapping possible is unique and also complex. It should prevent any misdoings from any participants.

In simple terms, there should be no occasion in the swap system that one of the parties has full control over both cryptocurrencies.

The timelock operation is the most important factor in making cross-chain swapping possible. Although many blockchains are available today for cross-chain swapping, not all of them can be connected to these kinds of swaps. A cross-chain bridge is essential for connecting blockchains and making the swap possible.

How Does a Cross-Chain Bridge work?

As the name implies, a cross-chain bridge makes it possible to bridge between blockchains. These bridges bring the opportunity to transfer tokens between separate blockchains.

Public blockchains – Ethereum and Bitcoin, for example – are designed in a siloed way to maximize security. Although their on-chain data is available for everyone, the blockchains can’t necessarily connect to each other and read/write data.

This natural design makes it somehow impossible for DeFi applications to easily provide practical use-cases to their users. Limiting users in one blockchain is not effective at all and results in less engagement for them.

There are some comprehensive cross-chain infrastructure solutions like Polkadot, Cosmos, and Avalanche that somehow solve the connection and interoperability issues of traditional blockchains. But there are still some users that prefer transacting between blockchains like Bitcoin and Ethereum. Cross-Chain Bridges are here to answer this need.

A cross-chain bridge provides interoperability between different networks. Separate blockchains like Bitcoin and Ethereum can be connected through these bridges. Besides, a bridge can connect a parent blockchain to its child chains, AKA sidechains. The connection comes with various use cases.

For example, tokens in one blockchain can be used in dApps on the other one. Tokens and data can be transferred fast and easy which results in smart contract interoperability. Besides, tokens hosted on small blockchains can benefit from fast transactions of another blockchain.

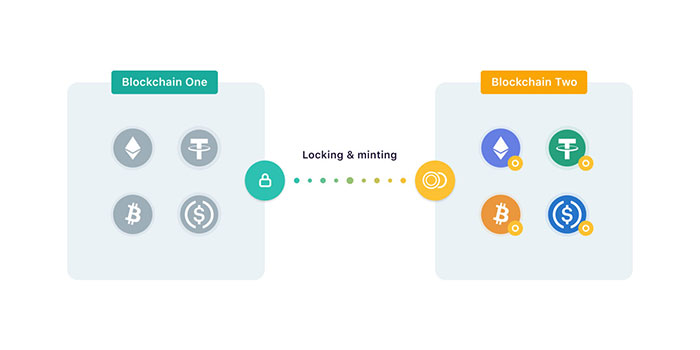

The bridging process doesn’t necessarily involve “sending” anything between blockchains. When a token is sent through a bridge from blockchain A to blockchain B, two steps happen:

- The tokens are locked in the source blockchain (A) using smart contracts or similar solutions.

- New tokens of an equal amount are minted or created in the destination blockchain (B).

The process above will happen backward when a user wants to redeem tokens from blockchain B to blockchain A.

The Future of Cross-Chain Swaps

Many experts believe the future of DeFi relies on cross-chain interoperability. There are numerous DeFi platforms out there serving lots of users around the world. They’ve shown their capabilities to serve financial needs in efficient ways.

But there are still lots of limitations in the DeFi industry. Users that need to transact tokens between blockchains have limited choices. A practical, efficient cross-chain bridge can solve this issue and become a de facto of universal financial solutions.

So, we can expect more cross-chain swaps to emerge in the future because there is an absolute need for them.

Cross-Chain Swaps, Benefits, and Disadvantages

Like any other technology, cross-chain swaps have pros and cons. They solve some problems but still need improvement, and software bugs are always there to limit the outcomes.

The most important pros and cons are:

Benefits

The most important benefit of a cross-chain swap is a new opportunity for decentralized exchanging of tokens. They provide the chance to trade tokens without the need for middlemen or centralized exchanges. After all, the opportunity to trade between blockchains surely attracts more users to the ecosystem.

Disadvantages

Cross-chain bridges are computer programs. These programs are always prone to bugs or bad code. So, when we put our money in cross-chain wallets, we accept the risk of software failures.

Besides, these bridges and swaps are still complex to use. You should try some platforms to find the best for swapping. New users may not find them helpful at first.

Some Cross-Chain Swap Platforms

Chainswap

Chainswap focuses on cross-chain applications and bridges to create a hub for smart chains. Adding new tokens is possible in this service and lets developers create a cross-chain token from the beginning.

Chainswap is basically an intermediary chain that enables cross-chain functionalities. This protocol works on a PoA (Proof of Authority) consensus algorithm. TOKEN is the native token in the Chainswap protocol.

Darwinia

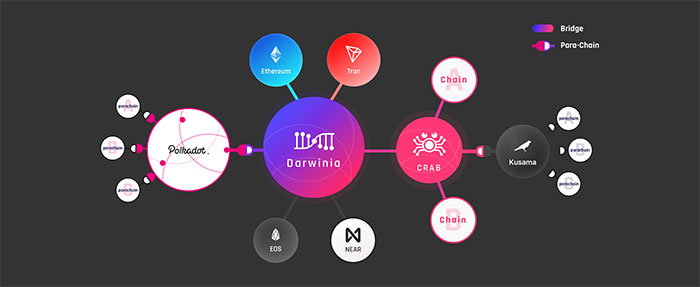

Darwinia Network, built on Substrate, is a cross-chain bridge connecting Polkadot, Ethereum, TRON, and all similar heterogeneous blockchains. It offers the opportunity for cross-chain asset transfers and also remote chain calls. RING is the primary token of Darwinia. It offers staking opportunities with KTON token rewards.

ChainX

ChainX is the first launchpad project on Polkadot. It’s focused on layer 2 expansions for Bitcoin. A digital asset gateway and creating a second-layer relay chain on Polkafot are other goals of ChainX. It’s focused on creating cross-chain bridges with Bitcoin as the first priority.

Polygon-Matic Bridge

Matic blockchain offers a cross-chain bridge between Polygon-Matic and Ethereum. It’s based on Plasma and PoS security and enables bridging the assets on the Matic wallet.

Interlay

Interlay is focused on blockchain interoperability for various blockchains. It focuses on creating a global cross-chain solution. Bitcoin, Ethereum, and Polkadot are the main focus blockchains for this bridge. But developers can work on other blockchains, too. The bridge is in initial steps and may add more blockchains, soo.

Conclusion

Cross-chain swaps are becoming a must in the crypto world. People understand the potentials of decentralized finance and now need more comprehensive solutions.

When they can trade their tokens across multiple blockchains, the use-cases will be way more. Besides, interoperability creates a global network of blockchains that can keep the security layer while providing practical use-cases.

Cross-chain bridges may experience major expansions in the near future as more universal blockchains are emerging and need a connection to older ones.