Occam is a suite of DeFi solutions for the Cardano ecosystem with a focus on helping new projects and offering various services. There are many services available in this suite that try to make Cardano a DeFi-friendly blockchain.

With the help of these services, developers can launch their DeFi platforms on Cardano, and users can benefit from numerous features and tools available in this blockchain.

The combination of services by Occam makes it possible for all kinds of developers and users to experience better DeFi services on the Cardano blockchain. Launchpad, DEX, and DAO are some of the services that become available on Cardano with the help of Occam.

The team behind Occam calls is Cardano’s Smart DeFi Layer. OCC is the native token in this layer and has numerous use-cases for developers and end-users.

What is Occam.fi?

Launched by Mark Berger and Paul Rieger, OccamFi tries to bring DeFi functionalities at their best form to the Cardano blockchain. For achieving the goal, many things should be done, and many services are needed.

A launchpad, for example, is needed to help new teams join the ecosystem and run their products on this blockchain. Decentralized exchange and other automated tools make it possible to provide a comprehensive solution on Cardano.

The complete suite of DeFi solutions for Cardano from OccamFi offers launchpad capabilities, DEX platform, and liquidity pools. It’s the first DeFi addition to the Cardano blockchain and can help it penetrate the market faster.

OccamRazer is the first tool in this suite that provides launchpad capabilities for new teams in the Cardano blockchain.

Ecosystem

As mentioned above, Occam is a combination of tools and services that bring DeFi capabilities to the Cardano blockchain. There are various benefits to these services. The ecosystem includes:

Continuous Ecosystem Diversification (CED)

The CED system is a rewards system for OCC token holders. Those who stake more than 150 OCC tokens for a specific period before the IDO will have access to this reward system. In simple terms, when you stake 150 OCC or more in the Occam ecosystem, you will receive rewards for every and each IDO that runs of Occam launchpad, OccamRazer.

Two weeks after each IDO on OccamRazr, the rewards will be distributed between the stakers. It creates a continuous reward distribution for them.

Razer App

OccamRazer is an app for decentralized fundraising for Cardano’s new projects. New projects can raise funds for their development and distribution needs via the Razer App. It provides a launchpad for them to introduce their projects and even run IDOs to raise funds.

The launchpad platform from Occam focuses on offering a safe, secure, low-cost, and easy experience for raising funds and investing in new projects. Small teams can easily launch their projects on this launchpad. There are numerous tools on OccamRazer that are designed to prevent fraud in launching new projects.

OccamRazer runs an IDO for the new projects in the launchpad. You can sign-up for your project here, enter the details of the project, and wait for the Occam team to contact you for IDO details.

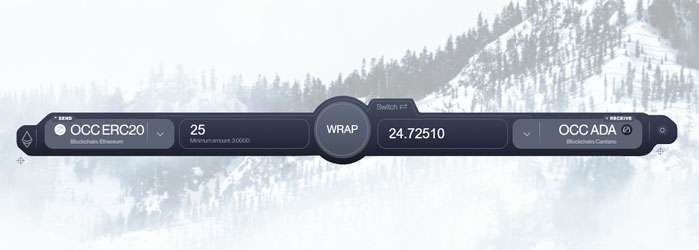

Occam Bridge

The bridge app in the OccamFi ecosystem is designed to make migrating the tokens simple. It helps users to swap their tokens between Ethereum and Cardano blockchains.

The Occam.fi Ethereum <> Cardano bi-directional liquidity bridge helps users move their assets between blockchains. Using this app, people can benefit from the DeFi services on both networks.

The bridge technology in the Occam Bridge is proprietary and is managed with the help of a centralized bridge system. An exchange partner helps this service to swap the OCC tokens on Cardano and Ethereum blockchains.

OCC The Token

OCC is the native token of the Occam ecosystem with numerous use-cases in its various products. It has fundamental roles in OccamRazer, OccamX, and in the governance layer governed by a DAO.

It will help Occam provide tokenomic incentives for users and also acts as the fuel in the whole ecosystem.

Token Utility

As mentioned above, OCC serves as the primary token in the whole Occam ecosystem.

It has numerous use-cases separated into two categories:

Core Utility

Governance and liquidity mining are the main purposes of the OCC token. In simple terms, it helps the decentralized platform run well and provides an incentive for liquidity providers. Those who provide liquidity for trading pools in the Occam DeFi platforms will receive OCC tokens as rewards. According to the official documents, “OCC tokens are gradually released from the Liquidity pool on a pro-rata volume-weighted basis.”

OCC token is also a governance token within the Occam ecosystem. Those who stake this token can participate in the governance mechanisms. A decentralized governance system, based on tokenomic incentives, guarantees continuous growth and improvement for OccamFi. OCC stakers can participate in various decisions, from system updates and changes in the system parameters to Occam DAO investments. They can use their staked OCC tokens to propose changes in the system or participate in voting for changes.

Auxiliary Utility

Some components of the Occam ecosystem are only available for OCC holders. For example, only they can send some OCC for OccamRazer pool origination. Besides, there are private pools available in this system that are only accessible for OCC stakers.

Private pools are advantages in the OccamRazer system for OCC stakers. If a pool originator launches it as a private pool, only OCC stakers will have access to it. The community will be notified by alarms, and private pools will be shown in special places in the interface. OCC stakers can also set automatic investment mechanisms for their profiles. The functionality is named AutoInvest. There are other auxiliary use-cases for the OCC toke. Referral link, Cast Out, and OCC raise are some of them. All of them are focused on continuous circulation for this token in terms of paying or advantages for holding it.

Where to Buy OCC?

OccamFi provides the OCC token in numerous centralized and decentralized exchanges. The token is available in Ethereum DEXs, and you can convert it later to the Cardano-based token.

Uniswap, Gate.io, DODO, 1inch Exchange, MEXC, BitMart, and HitBTC are some of the exchanges that support the OCC token.

About Cardano

Cardano is one of the most famous proof-of-stake blockchains that has been in the industry for some years. The community decided to expand its use-cases and enter the DeFi world.

Supporting smart contracts, native tokens, and interoperability with other blockchains are fundamental steps toward this goal. Platforms and protocols like Occam help this blockchain achieve goals faster. They make it easier for new projects to launch on an improved network easier.

Conclusion

Occam tries to offer the fundamental components needed to bring DeFi easier to Cardano. It has a suite of tools for launching new projects, fundraising, and exchanging tokens in this blockchain. It can become the gateway for many projects that are looking for more efficient networks for launching their dApps. Along the way, it can become the smart contract hub for Cardano.

Project links

- Web: https://occam.fi/

- Telegram: https://t.me/occamfi_com

- Medium: https://medium.com/occam-finance

- Twitter: https://twitter.com/OccamFi