TL;DR

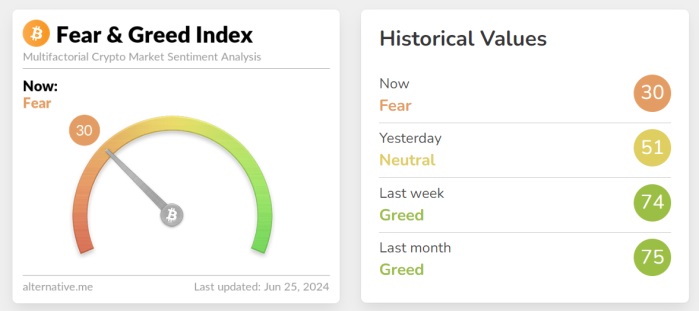

- The Crypto Fear and Greed Index has dropped to its lowest level in 18 months. Marking 30 points and reflecting a predominance of “fear” sentiment among crypto investors.

- Bitcoin has fallen below $60,000, its lowest level since early 2023.

- Sales of Bitcoin by the German government and Mt. Gox refunds are generating concerns about crypto market stability and their impact on short-term prices.

In recent days, the crypto market has been shaken by a sharp decline in the Crypto Fear and Greed Index, reaching its lowest level in 18 months with a score of 30, indicating a clear dominance of “fear” sentiment among investors. This index, known for its ability to measure confidence or caution towards Bitcoin and other digital assets, reflects changes in market behavior and perception since its last drop in January last year.

The index’s fall coincides with Bitcoin’s price decline, which recently dropped below $60,000 during yesterday’s session. Such price levels have not been seen since early 2023, when the market reacted to the collapse of Sam Bankman-Fried’s platform, FTX, at which time Bitcoin was trading around $17,000.

According to the latest data from Coinmarketcap, BTC is trading at $61,720 and its 24-hour trading volume has increased by 33%, reaching $38.77 billion. Additionally, the total market capitalization of the crypto market has slightly recovered, rising by 1.63% to reach $2.28 trillion.

Mt. Gox and German Government Sales Fuel Fear Among Investors

Among the factors contributing to the heightened level of fear are several events. On one hand, the scheduled refunds by Mt. Gox to customers affected by the 2014 hack have raised doubts due to the massive amount of BTC to be distributed. With over $8.5 billion in Bitcoin and Bitcoin Cash under the company’s trustee. The community is watching closely how these refunds could influence market prices and how creditors will progress with their indemnifications.

Furthermore, recent sales of BTC by the German government have exacerbated concerns. Following the seizure of 50,000 BTC earlier this year. The government has transferred about 1,700 BTC to exchanges such as Coinbase and Kraken. Sparking alarms about the potential impact of state sales on crypto market stability.

Market analysts have warned that these combined events could prolong the “fear” phase in the Crypto Fear and Greed Index. Affecting investor confidence and the volatility of Bitcoin prices in the short term.