TL;DR

- Bitcoin’s price fell below $94,000 due to uncertainty over the Fed’s interest rate decisions and President Trump’s protectionist comments.

- Despite the drop, crypto analysts remain optimistic about potential rate cuts in the coming months.

- The community is closely watching Fed Chair Jerome Powell for signals that could boost risk assets like Bitcoin.

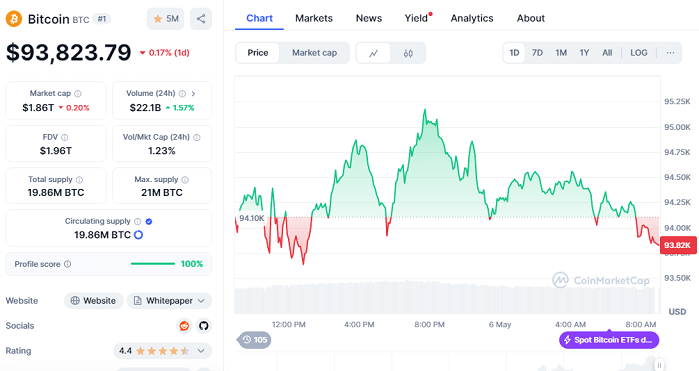

The cryptocurrency market kicked off the week with turbulence as Bitcoin dropped to $93,823.79, weighed down by monetary policy uncertainty (FED) and Donald Trump’s latest rhetoric. The president proposed a 100% tariff on foreign films, adding tension to already volatile markets.

According to CoinMarketCap, Bitcoin posted a 24-hour performance of -0.17%, with a market cap of $1.86 trillion, while XRP fell 2.7% to $2.12 and Solana slipped 0.8% to $146. Despite these setbacks, industry experts highlight that the crypto community remains optimistic, anticipating that future rate cuts could give Bitcoin and other digital assets a strong boost. Additionally, rising institutional adoption continues to provide a solid foundation for the market, with companies and asset managers expanding their crypto offerings to meet growing demand and innovation worldwide. As many market experts say, “uncertainty is even worse than bad news,” underscoring why investors crave clear signals.

Powell Under The Spotlight Of Global Investors

All eyes are on the Federal Reserve’s meeting this Wednesday, May 7. According to the CME FedWatch tool, markets assign a 97% probability that rates will stay in the 4.25% to 4.5% range. However, the real focus will be on Jerome Powell’s speech afterward, as it may offer hints about the Fed’s policy direction for the rest of the year.

Trump has publicly pressured the Fed to cut rates, but Powell has made it clear he won’t bend to political demands. In his recent remarks, Powell emphasized the economy’s overall strength and a robust labor market, signaling no urgent need for immediate cuts. Some committee members are reportedly divided over the pace of future adjustments, adding another layer of intrigue to Wednesday’s announcement.

Bitcoin’s Future Hinges On The Fed

Looking ahead to June and July, the odds of rate cuts rise sharply, reaching 75% for the next quarter. This is welcome news for crypto investors, as lower rates typically strengthen risk assets.

Despite the uncertain environment, many in the industry believe Bitcoin remains an attractive hedge against geopolitical tensions and protectionist policies. The long-term outlook remains promising for those who trust in decentralization and the resilience of the crypto ecosystem.