TL;DR

- Japanese firm Metaplanet acquired an additional 1,004 bitcoins worth $104.3 million, bringing its total holdings to 7,800 BTC.

- With this purchase, the company now owns crypto assets valued at $806 million based on current market prices.

- This move reinforces its crypto accumulation strategy, aiming to reach 10,000 BTC by the end of 2025, funded primarily through multiple bond issuances.

Metaplanet, widely referred to as the “MicroStrategy of Asia,” has just added another 1,004 BTC to its corporate treasury. This purchase, made at an average price of $103,873 per bitcoin, raises its total investment to approximately $712.5 million, with an average entry price of $91,343 per BTC.

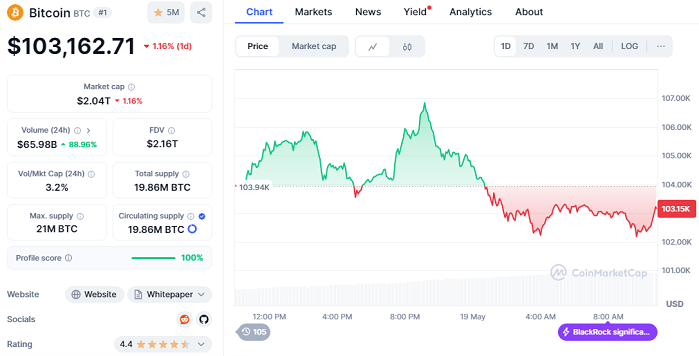

According to current figures — with Bitcoin trading at around $103,162.71, showing a -1.16% drop in the last 24 hours and a total market capitalization of $2.04 trillion — the company’s Bitcoin holdings are now worth approximately $806 million.

Since April 2024, Metaplanet has consistently accumulated Bitcoin as part of a crypto-forward treasury strategy. Its long-term goal is to reach 10,000 BTC by the end of 2025. This aggressive approach has been backed by a series of bond issuances, the most recent being a $15 million offering, its fifteenth since initiating this strategic pivot toward digital assets.

Moreover, the company has emphasized that its long-term vision is grounded in the belief that Bitcoin serves not only as a hedge against inflation but also as a safeguard against fiat currency devaluation and financial instability. Moves like these reaffirm Bitcoin’s growing appeal among non-tech corporations and position Japan as a rising hub for institutional crypto adoption in Asia. The market’s positive reaction suggests that investors are beginning to embrace corporate strategies centered on digital assets.

Bitcoin Gains Ground in Japan and Beyond

Metaplanet is now the largest publicly listed company in Asia in terms of Bitcoin holdings and ranks 11th globally, trailing behind U.S.-based giants like MicroStrategy, which leads with 568,840 BTC. The Japanese firm’s aggressive stance on Bitcoin is also paying off in the stock market: its shares surged 12.2% in Japan this Monday.

This latest move comes at a time when Bitcoin is hovering near its all-time highs, driven by strong institutional inflows and solid ETF performance. Metaplanet’s strategy further supports the idea that Bitcoin is not merely a speculative asset, but a store of value increasingly embraced by large corporations as part of their long-term financial planning.