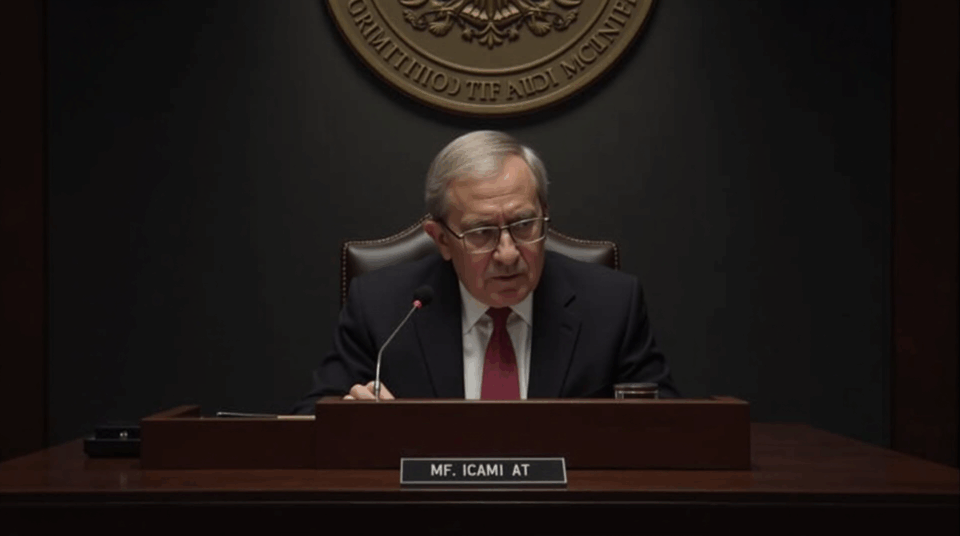

Stephen Miran’s appointment took place while the FOMC was holding an ongoing meeting, a confluence of events that placed the independence of the central bank at the heart of the debate. Markets, analysts, and economic policymakers reacted in a context marked by the expectation of a 0.25% rate cut and a legal dispute over the potential removal of Governor Lisa Cook.

The situation combined monetary policy expectations and institutional tensions, amplifying the perception of friction between the White House and the Federal Reserve just as the next steps in rate policy were being defined.

Context and Impact

Miran’s presence at the meeting introduced the possibility of a different vote within a committee that typically seeks consensus. The 0.25% projected cut was the most quoted data point, but the discussion took on another dimension due to the political implications of appointments and legal disputes.

The controversy surrounding Lisa Cook, including a legal challenge to her removal, added institutional uncertainty. The majority within the FOMC maintained a “wait and see” stance, anticipating one or two cuts in 2025, with probabilities for September and December. The FOMC, the body responsible for monetary policy decisions, is composed of twelve members, including seven from the Board of Governors, the President of the New York Fed, and four regional presidents rotating in and out.

Markets had to price in not only the interest rate move but also potential changes in governance and the quorum of the decision-making committee, in an environment of heightened sensitivity to political signals.

Implications

The risk of greater volatility in the markets increases due to the convergence of a controversial appointment and a decisive FOMC meeting. More visible discrepancies could emerge in the meeting minutes if new votes break the tradition of consensus, while the 0.25% anticipated cut started to be evaluated also for political reasons and not just macroeconomic ones.

Disputes over independence may affect credibility in the medium term. Although decisions will continue to depend on economic data and the internal balance of the FOMC, the political component has become more evident and is conditioning the market’s interpretation.

In summary, Miran’s appointment coincided with a scheduled FOMC meeting where a 0.25% rate cut was expected, and the debate on the independence of the central bank took center stage, with immediate effects on the perception of institutional stability.