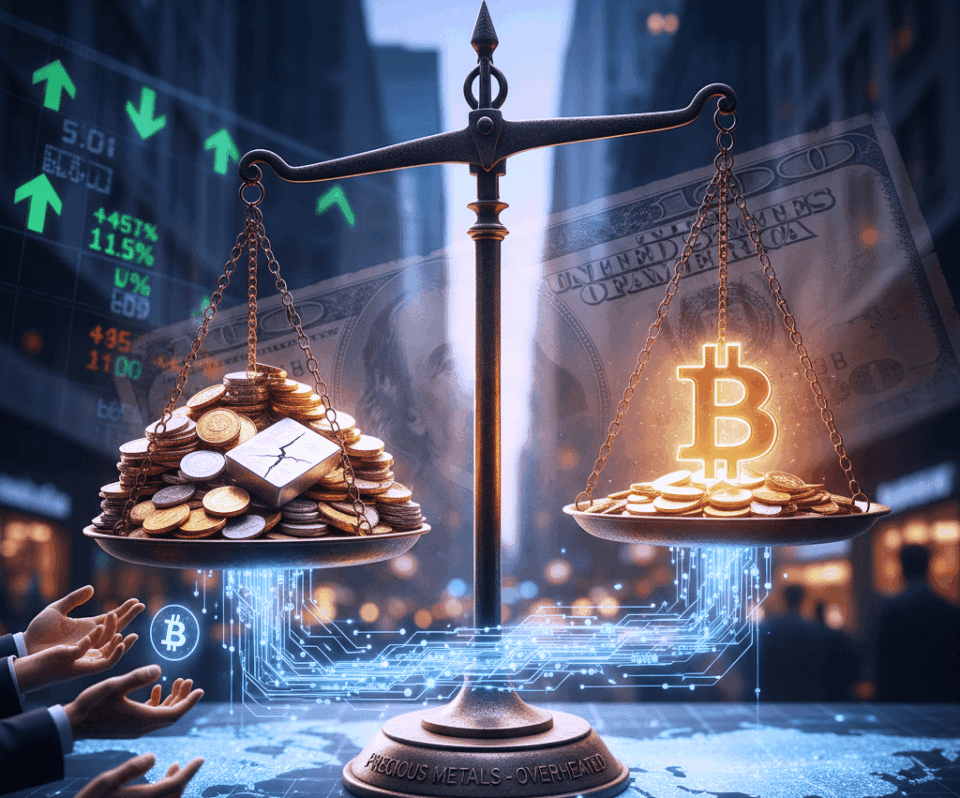

Financial market analysts are closely watching a significant shift in investment portfolios. The remarkable rise in precious metals appears to be reaching a turning point. This has caused interest to shift towards alternative assets like Bitcoin, which is perceived as undervalued. According to Nic Puckrin, founder of Coin Bureau, after gold’s impressive rally, attention may now turn to other alternatives that express a similar view.

This phenomenon occurs in a context of record prices for gold and silver. Gold has seen a surge of over 50% year-to-date, reaching $4,000 per ounce. Meanwhile, silver has surpassed $50 per ounce, marking a 45-year high. At the same time, Bitcoin has also shown its strength, reaching an all-time high of over $126,000 in October, demonstrating its growing acceptance.

Why is Bitcoin Becoming the New Gold?

The main reason behind this trend is the search for safe-haven assets. Both precious metals and Bitcoin serve a protective function against the devaluation of fiat currencies. However, the gold and silver markets are showing signs of being overheated for many. Consequently, the rotation of investors to Bitcoin is emerging as a strategic move. They are looking for an asset with greater growth potential in the short and medium term.

Furthermore, the narrative of Bitcoin as “digital gold” is gaining more and more traction in the global economy. Its decentralized nature and limited supply make it an attractive hedge. Unlike metals, it offers advantages in portability and divisibility, facilitating its use in digital transactions. This unique set of characteristics positions the cryptocurrency as a direct competitor to the traditional yellow metal.

The Weakening Dollar Strengthens Alternative Assets

The weakening of the U.S. dollar is a key catalyst in this scenario. According to analysts at Kobeissi Letter, the dollar is heading for its worst year since 1973. It has lost 40% of its purchasing power since the year 2000, leading to a loss of confidence among capital holders. This devaluation is pushing investors to seek alternatives that can more effectively preserve their wealth over the long term.

Matt Hougan, Chief Investment Officer at Bitwise, suggests that Bitcoin is well-positioned to capitalize on this situation. The ongoing devaluation of fiat currency will likely drive further accumulation of safe-haven assets. In this environment, the rotation of investors to Bitcoin seems not only logical but necessary. This trend is expected to solidify during the final quarter of the year, marking a new phase for global financial markets.