TL;DR

- Bitcoin could reach a new all-time high before the end of 2024, driven by improvements in the crypto market.

- The release of funds from FTX, between $5 and $8 billion, could inject optimism and increase the price of Bitcoin.

- Macroeconomic factors, such as a potential interest rate cut by the Federal Reserve, could also influence market behavior.

The price of Bitcoin (BTC) could experience a new all-time high before the end of 2024, according to several recent research reports. Various cryptocurrency-focused sources agree that market conditions are improving, opening the possibility for a substantial increase in the coming months.

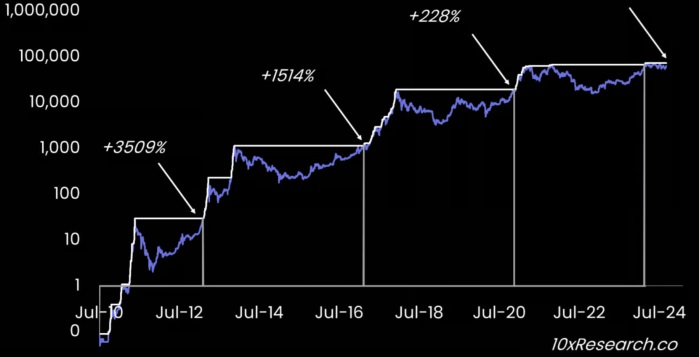

One of the most notable analyses comes from 10x Research, whose founder, Marcus Thielen, expressed optimism about Bitcoin’s future for the end of the year. Thielen mentions that one of the reasons behind this potential rally is the anticipated release of funds from FTX, which could inject between $5 and $8 billion into the crypto market. This capital influx could catalyze a positive sentiment among investors, contributing to a price increase for BTC and other cryptocurrencies.

In addition to this specific factor, the report suggests that the macroeconomic context could play a key role in the evolution of Bitcoin’s price. The Federal Reserve of the United States is adjusting its monetary policy, and according to some analysts, it may implement a reduction in interest rates, which could lead investors to reconsider their exposure to risk assets. This shift in economic policy could generate a realignment of portfolios, especially as we approach 2025, and affect the demand for BTC.

Eyes on Bitcoin Volatility

However, the report warns that despite the encouraging signs, investors should be cautious due to Bitcoin’s historical volatility. While the price could exceed previous levels, there is also the possibility of significant declines, making risk management essential. Key levels to monitor include the previous high of $68,330 and the 21-week moving average, which could serve as references for buying or selling decisions during turbulent times.

Meanwhile, improvements in market structure have been observed, with an increase in stablecoin issuance and a rise in leverage in Bitcoin futures. These factors, along with seasonal patterns, could be catalysts for an upcoming rally. However, any bullish movement will depend on the confluence of these elements and the behavior of global financial markets.