Bitcoin recorded a sudden dip yesterday after weeks of uptrends in which it set a new all-time high at $58,110. The top cryptocurrency had gained 40% in just the past two weeks and looked set to hit the $60,000 milestone. However, BTC whales descended upon the market and in a few hours, the price had dipped by close to 20%. As research now shows, some of these whales have a history of sparking massive price corrections.

Whale Season Coming to an End?

A whale is a Bitcoin address that has at least 1,000 BTC, as data analytics platform Glassnode points out. These addresses exert great influence on the market and are usually catalysts of great shifts in market momentum. This was most evident yesterday, February 22, when these whales started moving their BTC into the exchanges.

Data from Santiment, an on-chain data analytics platform, revealed the inflow into exchanges was up by close to 1,100%. This inflow was just before the massive correction, indicating that the BTC selloff by the whales sparked the price dip. 59,915 BTC moved into exchanges in just a single hour, Santiment observed.

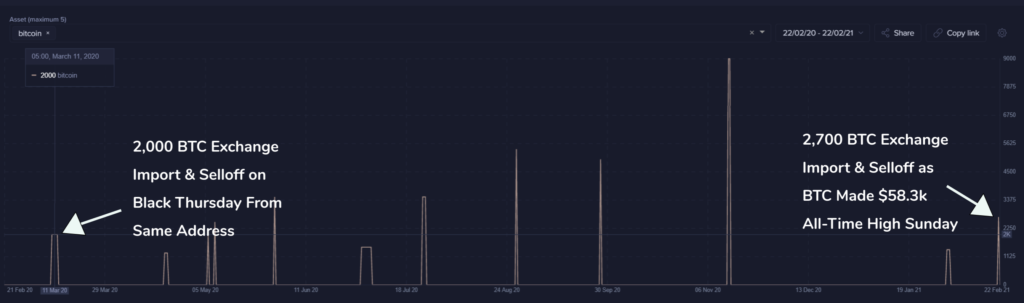

Santiment further revealed that one whale in particular had a history of massive dumps that spark price corrections. This particular whale moved 28,000 BTC into an exchange before instantly selling it off. The deposit was the largest of 2021, with the largest this year being 28,406 BTC on February 4. Incidentally, this whale dumped a similarly large amount of BTC just before the infamous Black Thursday. This was back on March 12 last year when the cryptocurrency market crashed by up to 60% in a day.

Image courtesy of Santiment.

Santiment revealed that the number of whale addresses with at least 1,000 BTC dropped from 2,462 last week to 2,416. This 1.9% drop shows that a number of whales have been selling off their BTC. Glassnode added onto this, stating that whale wallets have been increasing since March 2020. However, over the past two weeks, they have started to go down for the first time.

Gemini, the exchange owned by the Winklevoss twins, was largely responsible for most of the sell-off. As per data science firm Into The Block, of the 59,970 BTC that went into exchanges yesterday, 33,870 BTC went into Gemini.

What Happens Next?

Aside from the BTC that went into the exchanges, whales moved over $1.9 billion within other wallets, Glassnode notes in a blog post. However, it claims that “a sizeable portion of these coins may not be sold, but instead being restructured in custodial wallets.” This could be the whales placing their BTC in multi-signature schemes or custodians undertaking internal shuffling. Glassnode noted that this could possibly indicate that whales are getting ready to store their BTC for the long-term which is bullish for the cryptocurrency’s price.

Bitcoin has since slightly recovered after finding some support just below $46,000 and is trading at $47,100. It’s still down 12.3% for the week with its market cap now down to $880 billion. While this is still down from the $1 trillion market cap, it’s still the sixth most valuable asset globally, ranking higher than Facebook, Visa and JPMorgan.

According to one of the most renowned Bitcoin bulls, the slight dip shouldn’t worry investors. Michael Saylor, the CEO of Microstrategy, believes Bitcoin will pick itself back up and rally on. Speaking to CNBC, Saylor claimed that Bitcoin will flip gold first and subsume its $10 trillion market cap.

Then it’s going to subsume negative-yielding sovereign debt and other monetary indexes until it grows to $100 trillion. Once it gets to $10 trillion, its volatility will be dramatically less. As it marches toward $100 trillion, you’re going to see the growth rates fall, the volatility fall, and it’s going to be a stabilizing influence in the entire financial system of the 21st century.