TL;DR

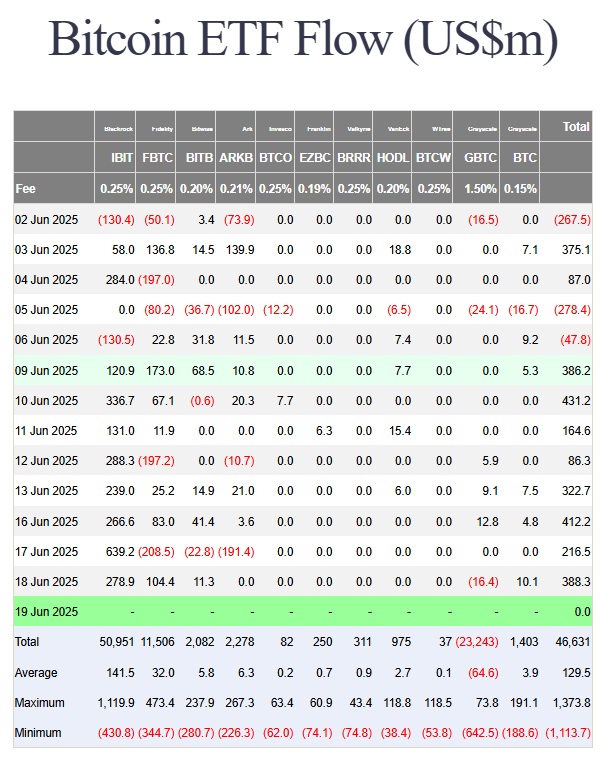

- Bitcoin ETFs in the U.S. posted $388.3M in inflows on June 18, marking eight consecutive days of net gains.

- BlackRock led the session with $278.9M, while BTC held steady above $104,000 despite tensions in the Middle East.

- Ethereum ETFs also resumed positive flows, and the market has seen over $11.2B in inflows since April.

Spot Bitcoin (BTC) exchange-traded funds (ETFs) in the United States brought in $388.3 million in inflows on June 18, completing eight straight sessions of net gains. BTC remained resilient in the face of political tensions in the Middle East, which at other times had triggered sharp reactions in risk markets.

According to data from Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) led the day with $278.9 million in inflows. It was followed by the Fidelity Wise Origin Bitcoin Fund (FBTC), which added another $104.4 million. The rest of the products saw more modest volumes, except for Grayscale, which reported $26.5 million in combined outflows from its GBTC and Mini Trust funds.

Altogether, the eleven spot BTC ETFs operating in the United States manage over $46.3 billion in assets. Since mid-April, they’ve only seen eight days of net outflows. BlackRock and Fidelity account for the largest share, managing $50.6 billion and $11.5 billion respectively, factoring both inflows and withdrawals.

Bitcoin Shows Its Resilience

Analysts at Santiment noted that Bitcoin remained stable between $104,000 and $105,000 throughout the session. They pointed out that this behavior mirrors what happened during previous episodes of geopolitical tension, when BTC recovered after an initial negative reaction.

Meanwhile, Ethereum ETFs also returned to positive flows. After a brief pause on June 13, they logged three straight days of inflows from June 16 to 18. BlackRock’s iShares Ethereum Trust (ETHA) leads this segment and has only seen two days without inflows since May 20.

The overall balance confirms that, despite uncertainty in other macro variables and isolated regional events, institutional demand for cryptocurrencies via ETFs remains strong in the U.S. Cumulative inflows have surpassed $11.2 billion since mid-April, and the market expects this trend to continue if conditions stabilize in the coming months.