TL;DR

- Bitcoin’s RHODL index is showing signs of slowing down, indicating a reduced inflow of fresh capital into the market compared to previous bull cycles.

- The RHODL behavior suggests a possible trend transition, as this indicator has historically signaled market tops and exhaustion during Bitcoin’s bullish phases.

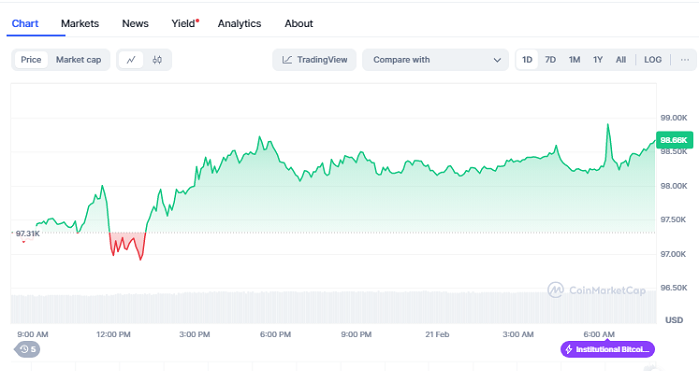

- Bitcoin’s price remains around $100,000 after rejecting $98,600, raising uncertainty about buyers’ strength in the short term.

A new market analysis has put the spotlight on Bitcoin’s RHODL index, a key indicator that measures the relationship between recently acquired coins and those held for longer periods. According to analyst Checkmate, the momentum of the RHODL index is losing strength, which could suggest a decline in the influx of fresh capital into the crypto ecosystem, potentially signaling a shift in market sentiment.

The RHODL index compares Bitcoin supply held between one week and two years, allowing analysts to assess whether a significant amount of new money is entering the market or if long-term investors still dominate the supply. Historically, when short-term capital outweighs long-term holdings, Bitcoin reaches market tops. Conversely, when this metric weakens, as it is now, price growth tends to slow down, often leading to increased uncertainty among traders.

End of the Bull Market or Just a Temporary Correction?

Although the metric points to a possible slowdown in the bullish rally, experts warn that it is not yet a definitive sign of a trend change. In previous cycles, Bitcoin has shown periods of consolidation before continuing its ascent, and the macroeconomic context also plays a key role. Factors such as growing institutional adoption and the possible approval of new BTC ETFs may offer an additional boost.

In addition, the regulatory landscape continues to evolve. Some countries such as El Salvador continue to expand their pro-Bitcoin strategy and other markets such as the United States are in full growth over the legality of ETFs and the impact of crypto mining.

In this context, some analysts believe that this cooling off is just a natural phase of the market before another upward surge, while others warn that Bitcoin could enter a period of higher volatility and possible corrections.

For now, Bitcoin has rejected the $100,000 resistance level and is hovering around $98,600, indicating that the market remains undecided. Crypto investors should closely monitor the RHODL index and other technical indicators to determine whether this slowdown is merely a pause before a new rally or the beginning of a deeper correction in the coming weeks.