The Bitcoin network’s seven‑day average hashrate slipped to about 993 exahash per second (EH/s), its lowest level since mid‑September 2025.

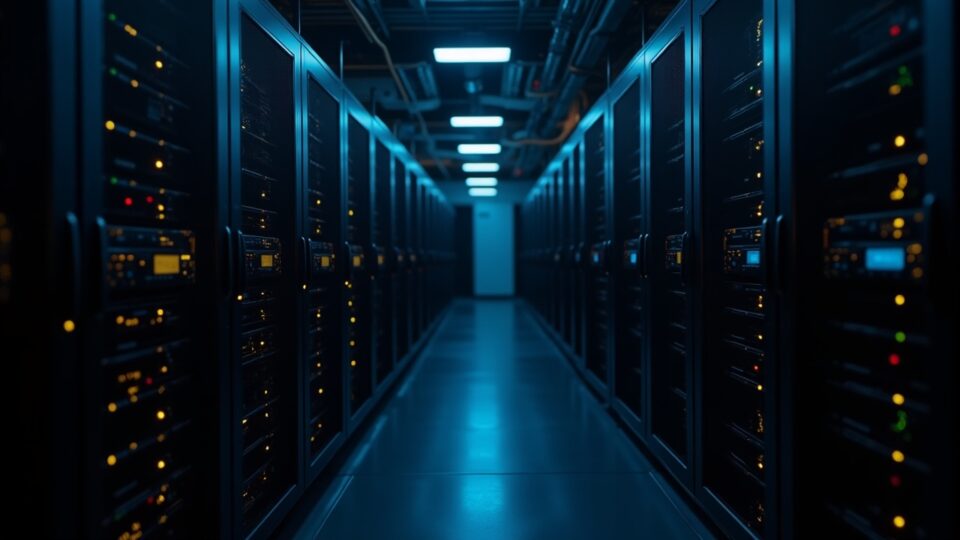

Data compiled from industry reports show a clear, coordinated shift: large miners are repurposing rigs, land and grid hookups toward AI hosting and HPC services. Reported revenue differentials are stark — AI contracts are cited as commanding up to 25x the revenue per kWh of Bitcoin mining in some cases, turning energy economics that once favored mining on their head.

Operators cite higher valuation multiples for data‑center style revenue and the potential to monetize stranded or underutilized energy capacity.

The decline — roughly a 15% contraction from the 1,157 EH/s peak on Oct. 19, 2025 — is being driven by miners reallocating computing capacity and power to artificial intelligence and high‑performance computing workloads that command substantially higher revenue per kilowatt‑hour.

Security, consolidation and corporate strategy

Lower aggregate hashrate raises theoretical security questions: a reduced compute footprint can make certain attacks relatively less costly in proportional terms, though the network remains large and a 51% attack would still be extremely expensive. More immediate is the risk of greater centralization. Smaller miners that lack capital to retrofit facilities for AI workloads may exit or be acquired, concentrating capacity with larger, better‑funded operators.

Beyond immediate revenue, miners are marketing their power contracts, land and grid interconnections as durable infrastructure assets. Analysts referenced a potential difficulty recalibration in January 2026 — an expected decline in network difficulty of roughly -4.34% to -5.45% — which is intended to rebalance mining economics and could influence whether some hashpower returns to the chain.

For investors and compliance teams, the pivot alters business risk profiles: exposure shifts from pure token price volatility toward counterparty and contract risk, energy‑supply and grid access issues, and new regulatory considerations for data‑center operations. For markets, the competition between AI and crypto for grid capacity amplifies the need for transparency around power contracts, environmental sourcing, and operational scaling.

Investors are now turning their attention to the January 2026 difficulty adjustment and to how quickly repurposed capacity can be reallocated — both factors that will determine whether the hashrate stabilizes or continues to reprice as part of a broader digital‑infrastructure industry realignment.

This episode underscores that mining economics are increasingly intertwined with the evolution of AI demand and energy markets, with implications for liquidity, access and strategic planning across the sector.