As the cryptocurrency rates calm down after the weekend, the market begins to move again. Bitcoin SV has grown by 20% and is ready to re-enter the top ten cryptocurrency top.

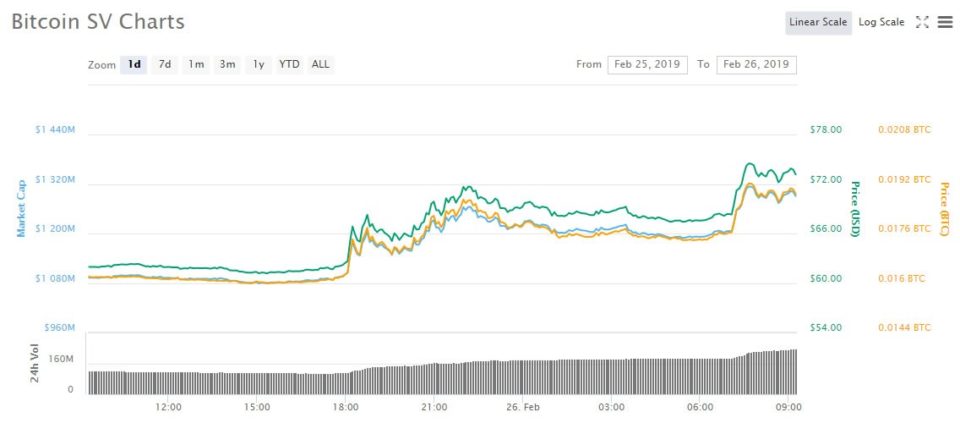

Over the past 24 hours, Bitcoin SV has grown from just over $ 61 to $ 74 before rolling back a bit. This massive movement has increased the BSV market capitalization to $ 1.3 billion by more than 20%, which allowed it to reduce the gap with Binance Coin, which is in tenth place.

BSV's daily sales increased from $ 110 million to $ 237 million. South Korea bought BSV during Asian trading today, as about 11% of the total was in KRW on Upbit and Bithumb.

Bitcoin SV is the revival of the original “Satoshi Vision” for Bitcoin. He appeared after the scandalous "hash wars" in November last year. His official website says:

“Bitcoin SV is the original Bitcoin. It restores the original Bitcoin protocol, maintains its stability and allows it to scale … Four fundamental principles form the basis of the Bitcoin SV roadmap for creating a single blockchain for the whole world: stability, scalability, security, and secure instant transactions (otherwise, 0-confirmation). ”

What caused a large increase in cryptocurrency?

The only fundamental news at the moment is a press release stating that Lithuanian fintech-based firm Coingate has included trading and payments for BSV. According to the report, the company serves more than 4,500 business customers and 80,000 registered users. Commercial Director Vilyus Semenas stated:

“As a bridge between cryptocurrency users and sellers, we are in a unique position to remove barriers between both parties. Nevertheless, we are pleased to make Bitcoin SV available to any buyer, without creating technical obstacles or adding overhead costs for sellers. ”

The company is approaching the introduction of cryptocurrency, offering many ways to customize online payments for merchants and consumers. It also provides a platform for buying and selling cryptoactive assets without the need for investment. A number of alternative payment methods can be used, such as mobile, credit cards and local payment providers.