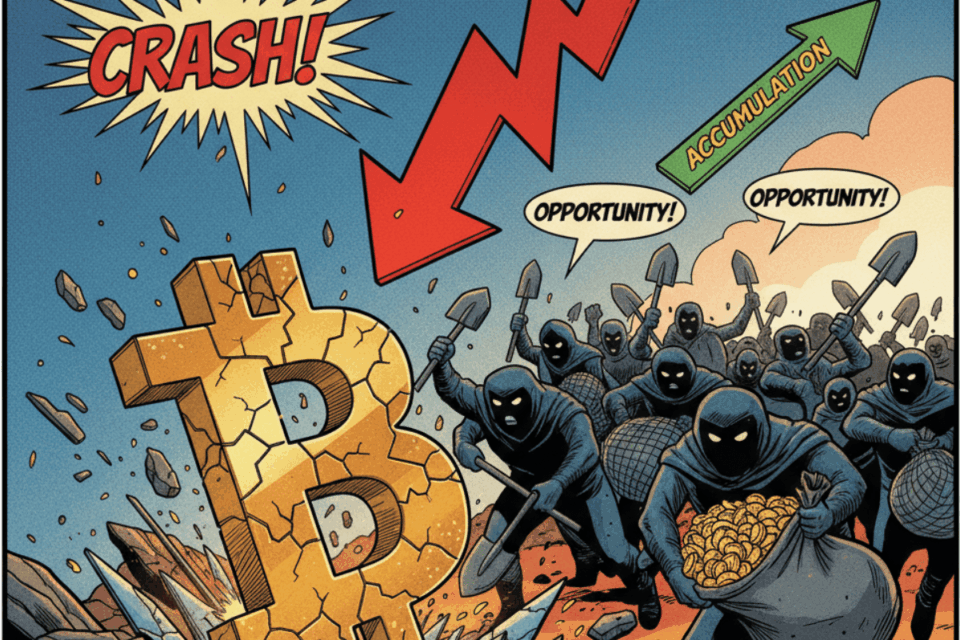

The price of Bitcoin has experienced a notable drop below the $109,000 mark, creating a wave of uncertainty in the market. However, recent data shows an interesting trend: while some are selling, spot buyers are intensifying their accumulation. According to market analysts, “this discrepancy between price and accumulation could be a bullish sign in the medium term.”

The recent fall of Bitcoin has brought its price to levels not seen in recent weeks, which has set off alarms for retail investors. Despite this outlook, figures indicate that large holders, also known as “whales,” have not only maintained their positions but have also increased their purchases. This strategic accumulation suggests that institutional investors see the dip as a buying opportunity, betting on a future recovery of the digital asset.

This market behavior is not new. Historically, the price of Bitcoin has shown high volatility, with price corrections often preceding new all-time highs. The relevance of this event lies in the growing participation of institutional investors, whose accumulation behavior during downturns can provide a more solid price floor and reduce long-term volatility.

The implications for the market and the asset are significant. If the accumulation trend continues, it could indicate that selling pressure is decreasing and that a solid foundation is being formed for the next upward movement of Bitcoin. For investors, this scenario presents both risks and opportunities. On the one hand, short-term volatility could continue; on the other, current prices could represent an attractive entry point for those with a long-term perspective.

The Future of Bitcoin: Between Volatility and Opportunity

The current situation of Bitcoin is a clear reminder of the complex dynamics that govern the cryptocurrency market. Although the drop below $109,000 has generated nervousness, the response of large buyers injects a dose of optimism. The coming weeks will be crucial in determining whether the current accumulation is enough to reverse the downward trend and lead Bitcoin to new price horizons.