TL;DR

- Matt Hougan of Bitwise predicts a crypto rally for the last quarter of 2024 as macroeconomic uncertainty clears.

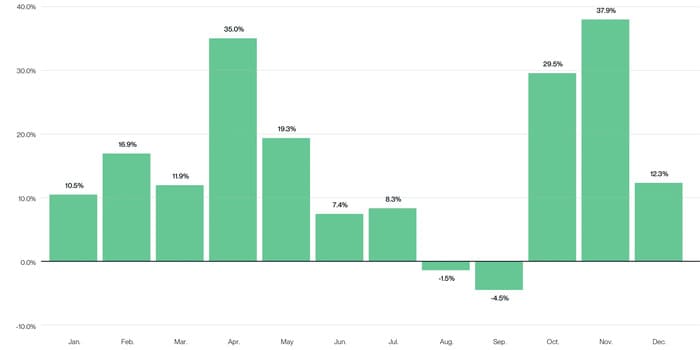

- September has historically been unfavorable for Bitcoin, with an average decline of 4.5% and a 3% decrease this month.

- Political uncertainty in the U.S. and the debate over interest rate cuts are influencing market volatility.

Matt Hougan, Chief Investment Officer at Bitwise, has made an optimistic prediction about the future of the cryptocurrency market, suggesting that a rally could materialize in the last quarter of 2024 as the current macroeconomic uncertainty clears.

Hougan bases his forecast on the hope that the volatility and doubts that have characterized the markets in recent months will begin to dissipate in October and November.

Historically, September has been a difficult month for Bitcoin, with an average price decline of 4.5% since it began trading in 2010. This month has shown negative performance in 9 of the 13 years recorded, with an extreme drop of 41.2% in September 2011.

This pattern of decline in September appears to align with current expectations, as BTC has suffered a decrease of approximately 3% so far this month.

The current macroeconomic uncertainty is influenced by several factors. The U.S. presidential election is at a point of uncertainty, with polls and prediction platforms showing varied results about the potential winner.

U.S. Uncertainty Keeps the Crypto Market on Edge

This political uncertainty is affecting market psychology and, therefore, the performance of cryptocurrencies. Additionally, the timing and scale of interest rate cuts by the Federal Reserve remain under debate, with expectations of cuts by the end of the year.

On the other hand, investment flows into Bitcoin and Ethereum exchange-traded funds (ETFs) have shown a mixed trend. While flows have decreased and Bitcoin ETFs have experienced their longest net outflow streak since their launch, investment advisors are adopting these funds at a record pace.

Hougan also attributes the poor performance in September to seasonal factors and SEC enforcement activity, which tends to intensify towards the end of the fiscal year. This increase in regulation may be putting pressure on cryptocurrency prices.

Despite these challenges, Hougan maintains a positive outlook for the rest of the year, hoping that October and November will bring a resurgence for the crypto market, in line with historical trends that have favored cryptocurrencies during these months.