TL;DR

- Brown University makes its first Bitcoin investment through BlackRock’s ETF.

- The investment, now valued at $5.8 million, highlights Bitcoin’s growth potential.

- This move underscores how institutions are adopting Bitcoin as part of a secure, diversified strategy.

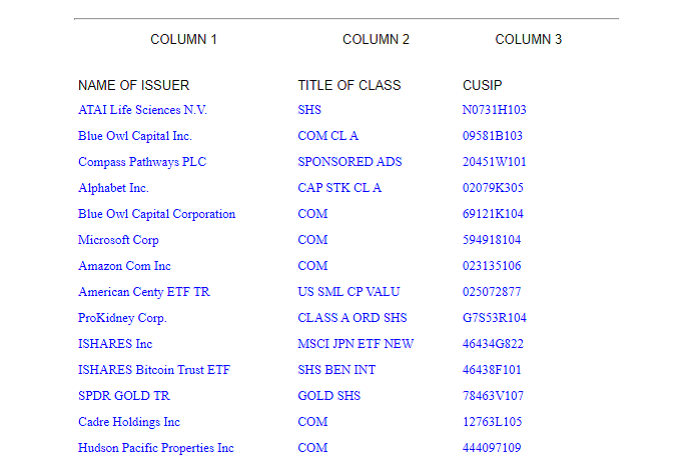

Brown University has taken a decisive step by investing $4.9 million in BlackRock’s iShares Bitcoin Trust (IBIT), marking its first entry into the crypto market. According to a filing with the SEC, the university owns 105,000 shares of the ETF, which were worth $5.8 million by the end of the first quarter of 2025. This move reflects the growing interest of institutions in digital assets, taking advantage of the security and regulation that ETFs offer. Additionally, this specific ETF allows universities and large investors to gain exposure to Bitcoin without the complications of direct ownership and management of the cryptocurrency. This step shows Brown’s adaptability and forward-thinking approach to asset management.

Brown’s decision reflects a prudent yet innovative approach, diversifying its portfolio with an asset that, although volatile, has shown impressive growth in recent years. By making this investment, Brown joins a growing number of universities that are recognizing Bitcoin as a viable long-term asset class. The cryptocurrency is no longer seen as a niche option but as a serious component of investment portfolios, offering an attractive alternative in an increasingly digitalized global financial environment, where Bitcoin’s potential is recognized.

The Future of Institutional Crypto Adoption

Brown is not the only educational institution betting on Bitcoin. Universities like the University of Austin and Emory University have also expressed interest in the crypto asset, incorporating it into their endowment funds. This signals a significant shift in institutional thinking, where cryptocurrencies are now seen not only as a passing trend but as a legitimate and regulated asset class. In fact, the use of ETFs to acquire Bitcoin makes investment safer and more accessible, attracting institutional investors who were previously reluctant due to the lack of direct regulation in cryptocurrency markets.

As more institutions follow this path, the future of Bitcoin in institutional portfolios looks increasingly promising. This kind of institutional movement is crucial for the mass adoption of Bitcoin, showing that cryptocurrencies are becoming more integrated into the global financial system, reinforcing trust in their role as a store of value, growth asset, and long-term hedge against economic uncertainty.