TL;DR

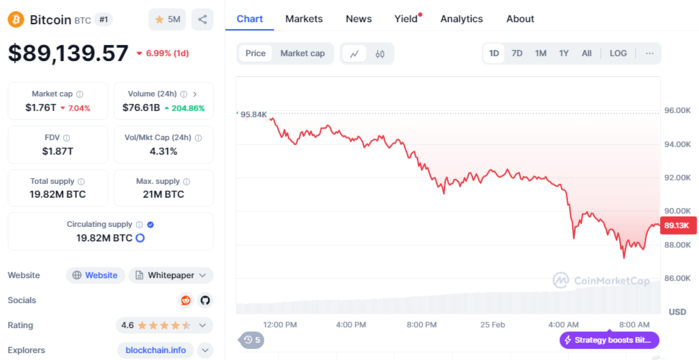

- BTC has dropped to $89,139, its lowest point since January, losing over $10,000 from Friday’s peak, sparking major uncertainty in the market.

- More than $1 billion in positions have been liquidated, affecting over 310,000 traders, with 95% coming from long positions, increasing fear among investors.

- The Crypto Fear and Greed Index plummeted from 49 to 25 in a single day, reflecting the crash’s impact and heightening uncertainty. This suggests the market could be at a turning point.

Bitcoin has broken a critical support level, dragging the entire crypto market into a sharp correction. After reaching a peak of $99,500 on Friday, driven by positive news from Coinbase regarding its legal battle with the SEC, the cryptocurrency has plunged to 2025 lows, trading below $90K. This collapse has been accompanied by massive liquidations, totaling over $1 billion in losses for traders, most of whom held long positions, intensifying selling pressure in the market and triggering a domino effect across digital assets. Investors are now closely watching key support levels, as a failure to hold could lead to even deeper corrections in the short term.

The drop accelerated following the largest hack in the sector’s history, in which over $1.4 billion in crypto, mainly in ETH, was stolen from Bybit. This event had a cascading effect, impacting not only BTC but also altcoins such as ETH, SOL, XRP, and ADA, which suffered double-digit losses within hours. Extreme volatility has forced investors to reconsider their strategies as exchanges report a surge in sell orders. Additionally, macroeconomic uncertainty and recent statements from the Federal Reserve about possible monetary policy adjustments have contributed to the bearish sentiment.

BTC is currently trading around $89K, experiencing a 7% decline in the last 24 hours amid heightened market volatility and uncertainty.

Buying Opportunity or Further Decline Ahead?

Despite the panic, some analysts view this correction as an opportunity. Historically, extreme levels of fear in the Crypto Fear and Greed Index have preceded strong market rebounds. In fact, the index has dropped from 73 (Greed) a month ago to 25 (Extreme Fear) today, signaling a possible capitulation before a bullish reversal.

Moreover, Bitcoin’s fundamentals remain solid: institutional adoption is growing, BTC ETFs continue to see positive inflows, and the 2026 halving is approaching, which could further reduce supply and drive a recovery in the coming months. However, the key question is whether BTC can reclaim the $92,000 resistance level or if bears will continue to push prices lower, leading to new lows and prolonging market uncertainty. With whales accumulating at strategic levels and governments increasing their focus on crypto regulation, Bitcoin’s next move could shape the market’s direction in the short and medium term.