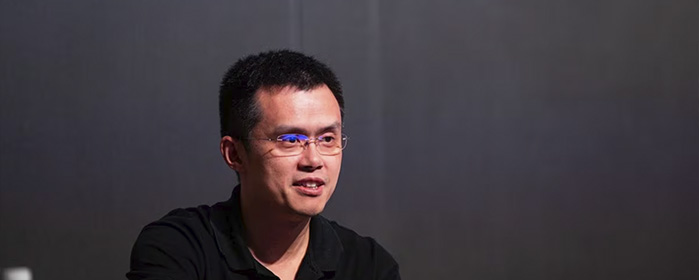

Former Binance CEO Changpeng Zhao, commonly known as CZ, has pleaded guilty to money laundering violations in front of a US district judge.

This admission of guilt is the result of a lengthy investigation by federal regulators and has led to one of the most significant corporate legal settlements to date.

Judge Richard Jones, based in Seattle, Washington, has accepted Zhao’s guilty plea.

As part of this agreement, Binance, the cryptocurrency exchange platform, has agreed to pay an extraordinary fine of $4.3 billion.

Additionally, Zhao has personally accepted an additional $50 million fine.

This decision comes after Zhao’s resignation last week from his position on the board of directors of Binance.US, where he served as president.

He has also left behind his roles as CEO of Binance and Chairman of the Board of Directors of Binance.US, significantly reducing his direct influence on Binance’s operations in the United States, limiting it to a purely economic interest.

The final verdict on Zhao’s sentencing is scheduled for February 23, 2024, and there is a possibility that he could face up to 18 months in prison.

Actually, he is currently free on $175 million bail.

Changpeng Zhao return to the United Arab Emirates, where he currently resides, is under judicial consideration

Federal prosecutors have expressed concern about his possible escape to avoid returning to the United States and serving his time in prison.

As part of the agreement between Binance and the authorities, the company must implement a regulatory oversight system that allows observers to report to the Department of Justice and the Department of the Treasury.

Richard Teng has taken over as Binance’s new CEO, confident he can lead the company through this new regulatory phase.

This case highlights the growing regulatory pressure on the cryptocurrency industry and serves as a shocking reminder of the consequences that exchange companies may face vis-à-vis the United States.